Here goes Tuesday. The bitcoin price has sort of settled into a range bound pattern over the last couple of days, and we haven’t gotten off to the kind of week we would have liked. Not fully, that is. We managed to get in and out of the markets on a long position yesterday afternoon, which we documented in the evening analysis, but price doesn’t seem to want to pick up a sustained run, and this makes things a little less interesting than they otherwise might be. Break, close, run, take profit. That’s the ideal entry, and that’s what we are looking for today. We’re going to be a little more aggressive with our targets on both sides of the fence, as this frees up a little bit of room for some stop loss widening, which should – in turn – help us to avoid any choppy action.

So, with this in mind, and as we march forward into today’s European morning session, let’s put some key levels together in an attempt to navigate today’s markets.

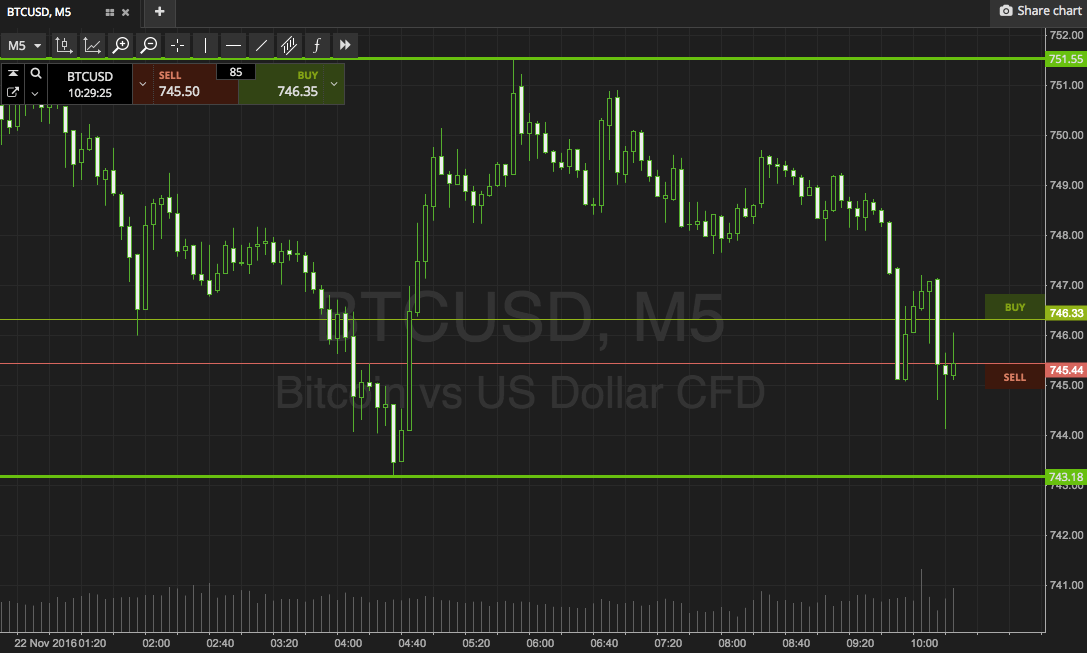

As ever, the chart below is a five-minute candlestick chart and it displays the overnight action in the bitcoin price. Take a look at that before we get going.

So, as the chart shows, the range in focus for today’s morning session is defined by support to the downside at 743 and resistance to the upside at 748. If we see price close above resistance, we are going to get in long towards an upside target of 756. A stop loss on this one at 745 works fine to keep risk controlled.

Conversely, a close below support signals short toward 735. Again we need a stop loss, and somewhere in the region of 746 looks good for the entry.

Let’s see how things play out.

Happy trading!

Charts courtesy of SimpleFX