Well, things just got pretty interesting. Earlier this morning, in the first of our daily coverages, we noted that things had been pretty dull all week, and that we had seen nothing in the way of sustained momentum – a steady decline in price aside. We also noted, however, that price was going to have to turn around soon if our long term bias was to be proven correct. Regular readers will be familiar with our thesis. For those that are new to this coverage, however, we’ve been saying for the last few days that the 1100-200 region in the bitcoin price should serve as a decent level of long term support. The run up we saw earlier on in the year, we felt, was a spike, and the subsequent correction was valid. However, as that correction found a floor, and price returned to run up to the long side of the market, we think buyers came in to provide some degree of supportive friction to stave off any corrective reversal.

This thesis has been tested this week, as price dropped very close to the 1100 lower range of our longer term support region. Just as it was about to fall apart, however, we got the recovery we needed for validation, and price is now back up in and around the 1200 region.

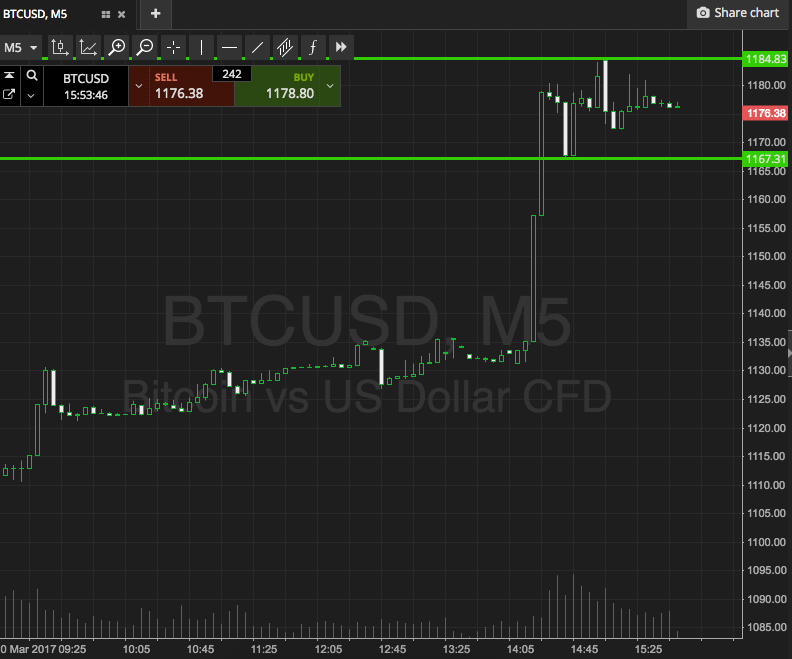

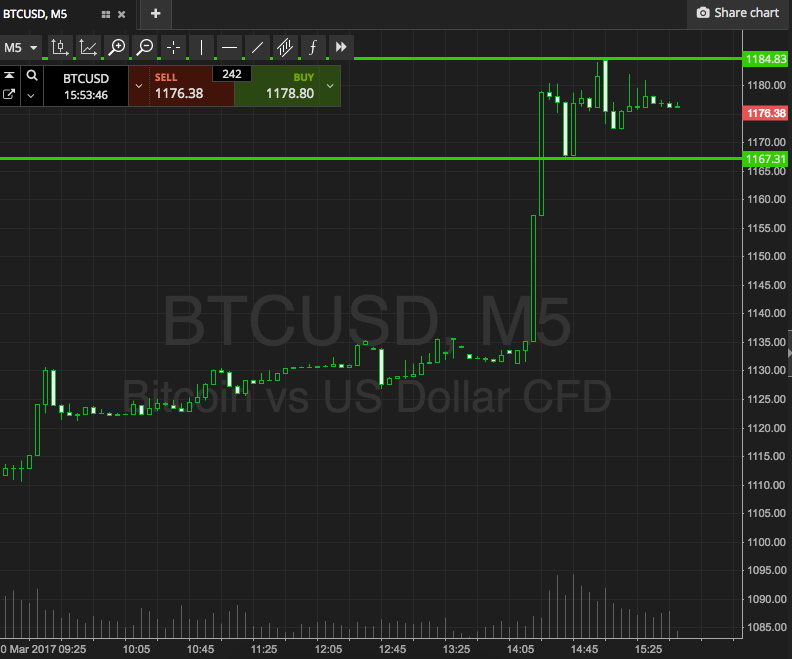

So this evening, we’ve got a range defined by support to the downside at 1167, and resistance to the upside at 1184. We’re going to bring our standard breakout approach to the fore this evening, so if we see a break and a close above resistance, we’ll look to get in long towards an immediate upside target of 1200. Conversely, a close below support will get us in towards 1157.

Stops just the other side of the entries on both trades define risk.

Have a good weekend!

Charts courtesy of SimpleFX