Overnight action was a real roller coaster in the bitcoin price, with things initially taking a steep turn to the downside and correcting considerably before recovering somewhat to trade pretty strongly into early morning Europe. With any luck, we will see a continuation of this strength as the European session matures and, as far as key levels are concerned, we should have some pretty solid ones in place given the strength with which we are trading right now.

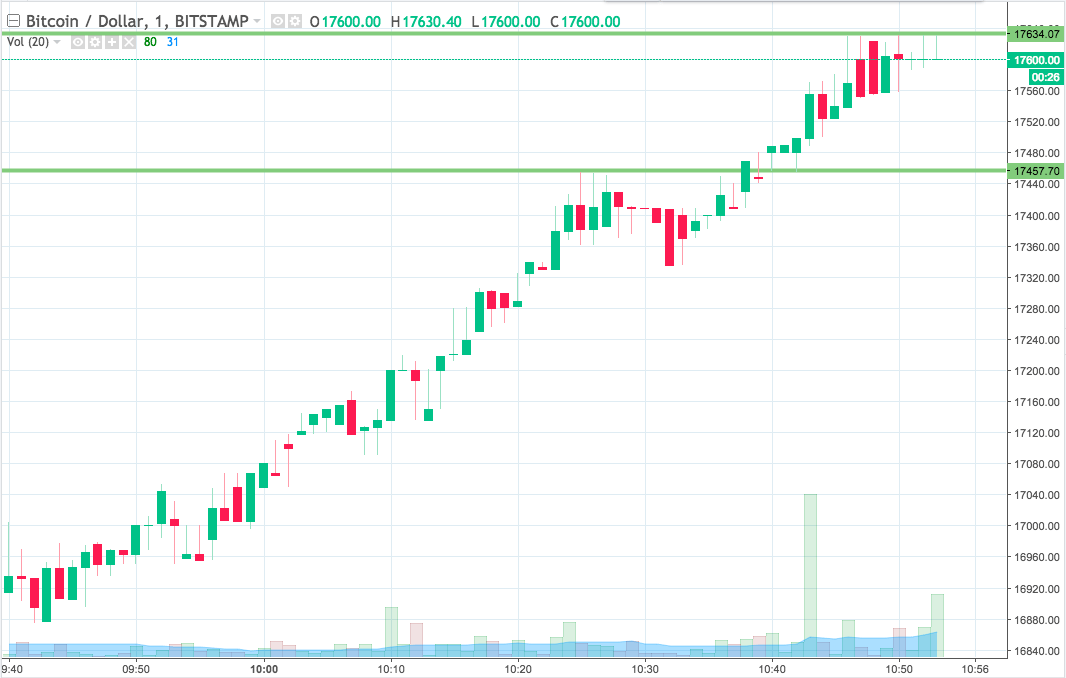

So, with this said, let’s get things outlined for the forward session and see if we can jump right into the market and take profit on any action. As ever, take a quick look at the chart below before we get started so as to get an idea where things stand and where we are looking to jump in and out of the markets as and when things move. It is a one-minute candlestick chart and it has our primary range overlaid in green.

As the chart shows, the range that we are looking at for the session right now comes in as defined by support to the downside at 17457 and resistance to the upside at 17634. If we see price break through resistance, we will enter into a long trade with an immediate upside target of 17700. A stop loss on this position somewhere in the region of 17600 (current prices) will ensure we are taken out of the trade if and when things turn against us.

Looking the other way, to the downside, we will look out for a close below support to signal a short entry. The same concept applies, just in reverse, so we will target a downside profit-taking exit point in and around 17380 and we will place a stop loss somewhere in the region of 17480 to get us out in case things turn bad.

Let’s see what happens.

Charts courtesy of Trading view

very nice