Ok, let’s get things kicked off for a fresh week of trading in the bitcoin price. Things have been pretty inconsistent over the last couple of weeks. We got what looked to bet he start of some degree of sustained incline around mid November, but the incline tapered off as it got closer and closer to 800 flat, and having topped out around twenty dollars or so short, has since corrected to current levels in and around the 740-750 mark. This is still not a bad run when you zoom out a bit and look at the longer term charts, but it’s not great for our intraday strategy, and it hasn’t left too much room for us to play with (by way of the tight range) on the five minute sticks.

Anyway, with any luck, things will heat up again this week. Thanksgiving no doubt played on Volume last week, so that will have had some say in the correction. If and when volume picks up tis week, we should see some level of run carry price through to highs once more.

So, with that said, and as we move forward in to today’s European session, let’s take a look at what we are going for, in an attempt to carve out some form of strategy on today’s price action.

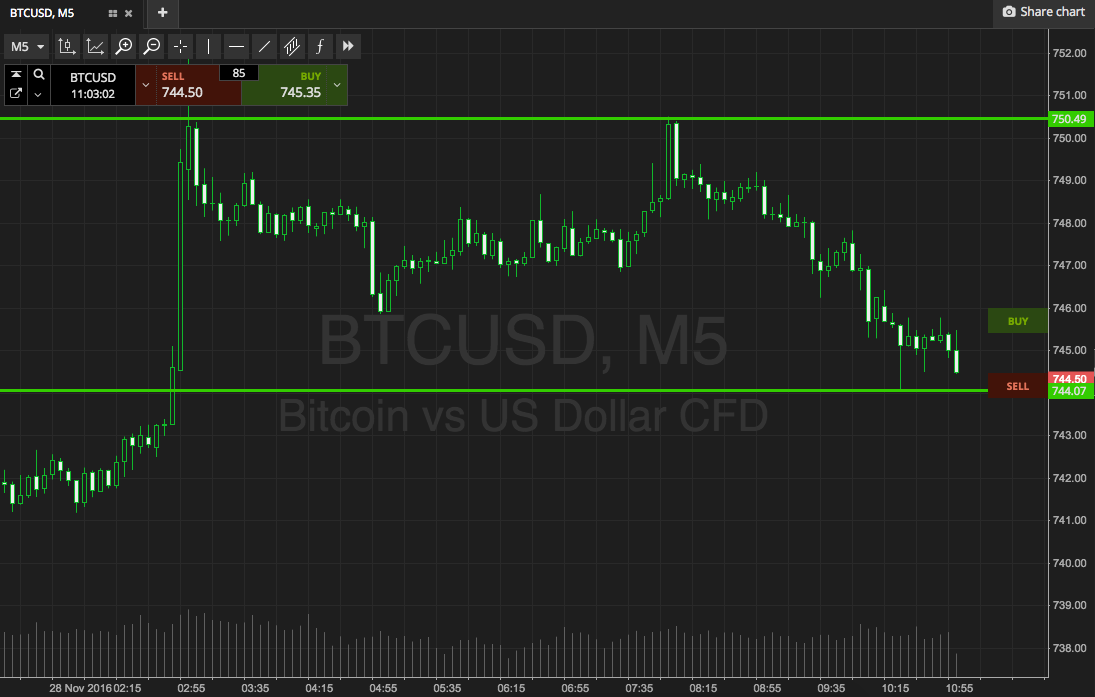

As ever, take a look at the chart below to get an idea of the key levels for today.

As the chart shows, the levels in focus this morning are support to the downside at 744, and resistance to the upside at 750. There’s not really enough room to go at price with an intrarange approach given current spread, so we’ll stick with breakout scalps for now.

Specifically, if price can close above resistance, we will get in long towards an initial upside target of 758. Stop at 747. Looking short, a close below support will signal a downside entry towards 737 flat. A stop on this one somewhere in the region of 747 once again keeps our risk tight.

Charts courtesy of SimpleFX