In last night’s bitcoin price watch analysis, we took a look at what had happened throughout the day, and noted that the way price was moving made it pretty tough to maintain a steady strategy during the latter half of the week. Not that we haven’t been able to draw profits from the market – things have been pretty good to us – but that being able to keep things tight from a risk management perspective is a little harder than normal.

Anyway, for the final day of the week, we’re going to shuffle things around a little. Specifically, we’re going to widen out our range to a width that we wouldn’t normally use. This will necessitate the use of some pretty aggressive targets, but we can also bring in some slightly wider risk management parameters than normal in light of these targets.

So, with that in mind, and as we move forward in to the session this morning out of Europe, let’s outline some key levels to go at, and see if we can end the week on a high.

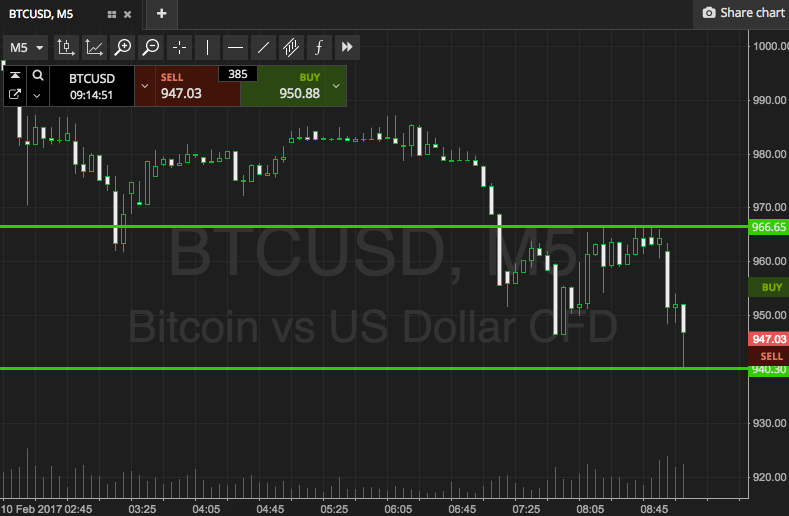

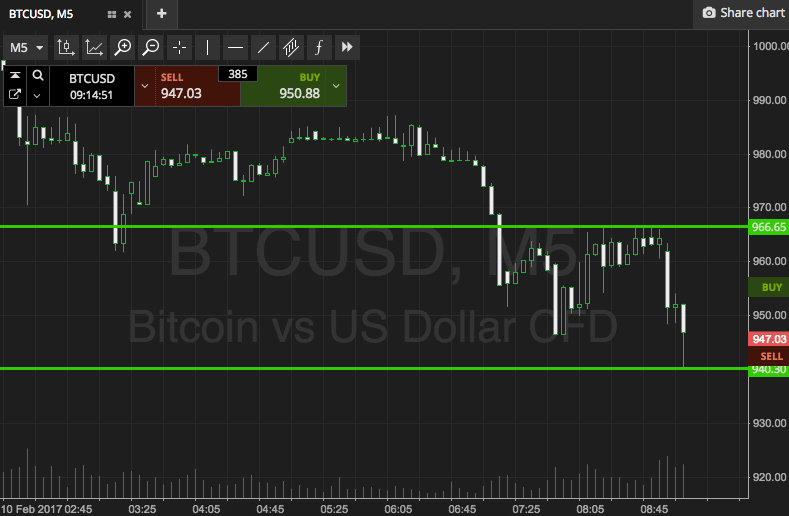

As ever, take a quick look at the chart below before we get going so as to get an idea of what happened overnight, and where we are targeting today.

As the chart shows, the range in focus is defined by support to the downside at 940, and resistance to the upside at 966.

That’s about $26 of range, so intrarange is on. Long at support, short at resistance, stops just the other side of the entry and targeting the opposing levels.

If we see price close above resistance, we will aim to get in long towards an immediate upside target of 988. Conversely, a close below resistance will put us in short towards a target of 950 flat. Again, stops just the other side of the entry to get us out if things move against us.

Charts courtesy of SimpleFX