Sometimes, short, sharp movements can offer up nice quick turnaround trades for our bitcoin price intraday strategy to take advantage of. After a week of two of strong fundamental shifts, and some technical highlights, we decided to batten down the hatches yesterday evening and tighten things up for a narrow scalp strategy. Things we had a live trade running as we took our positions, and this was a short scalp position with a narrow downside target, entered a little earlier in the day on a break of support.

This trade quickly completed and we managed to draw a profit from the market on the downside. We also managed to get in again to the downside on our refreshed range, and picked up a secondary profit as part of what we might deem an extension of our initial position.

Now, as we head in to a fresh day’s trading in the bitcoin price, we’re going to go at price with a very similar approach. Narrow, range bound action and an entry if (and only if) price breaks through either support to the downside or resistance to the upside, and closes below these levels to confirm bias.

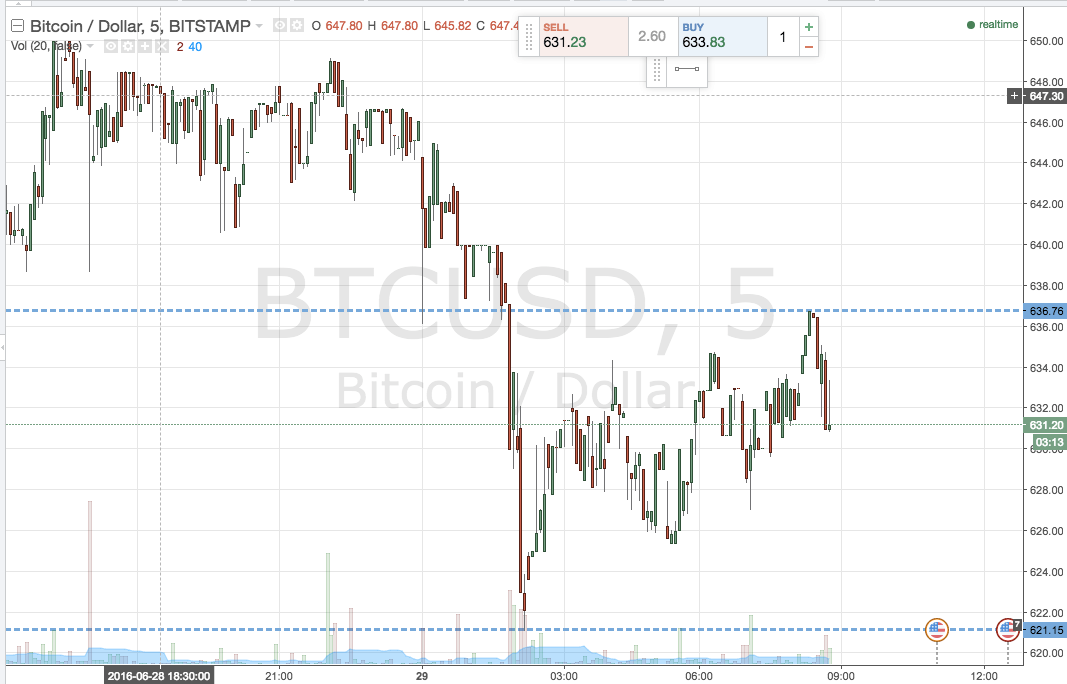

So, with this said, take a quick look at the chart below to see what range we are focusing on.

As the chart illustrates, the range in question is defined by in term support at 621 flat, and in term resistance to the upside at 636. These two levels represent the most recent swing low and high respectively, and should hold firm ahead of a sustained move – exactly what we are looking for.

So, long on a close above resistance with an upside target of 650 flat. A stop at 632 keeps risk tight.

Short on a close below support with a stop loss around 625 and an initial downside target of 610.

Happy Trading!

Charts courtesy of Trading View