So there we go – another day done in our bitcoin price trading efforts, and one that we can’t really say too much about. For those that missed our earlier coverage, we basically outlined the fact that we were looking at 1200 to the upside as the next major level on which to keep an eye. If price reaches this level, action in and around it (subsequent to its reaching) should tell us what we can expect near term from the bitcoin price.

If we see a break, we expect a near term run (we applied a similar concept to the breaking of the 1100 level over the weekend). If we see a correction, we’re probably looking at price trading in and around the 1150 region for a while.

That’s what we said, anyway, and today, we’ve not seen either of these two things happen. This leaves us in something of a limbo position. Price remains flat, and we can do nothing more than keep shifting our short term ranges to accommodate this sideways action, and any small amounts of volatility it brings with it.

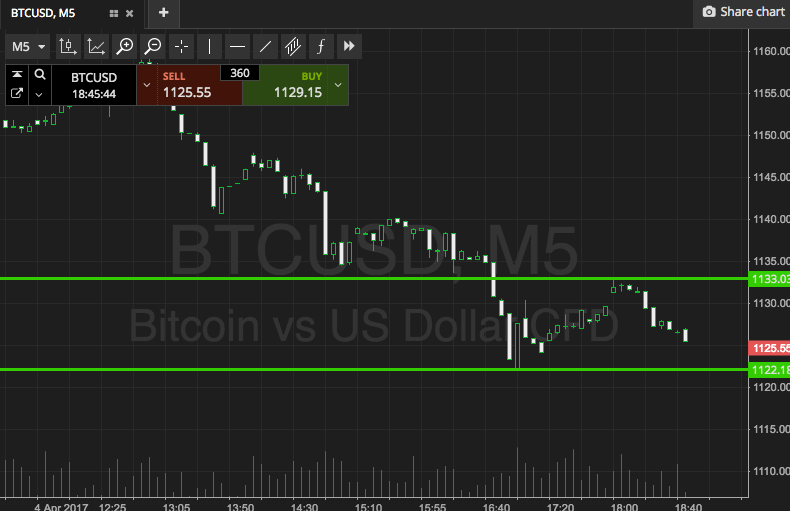

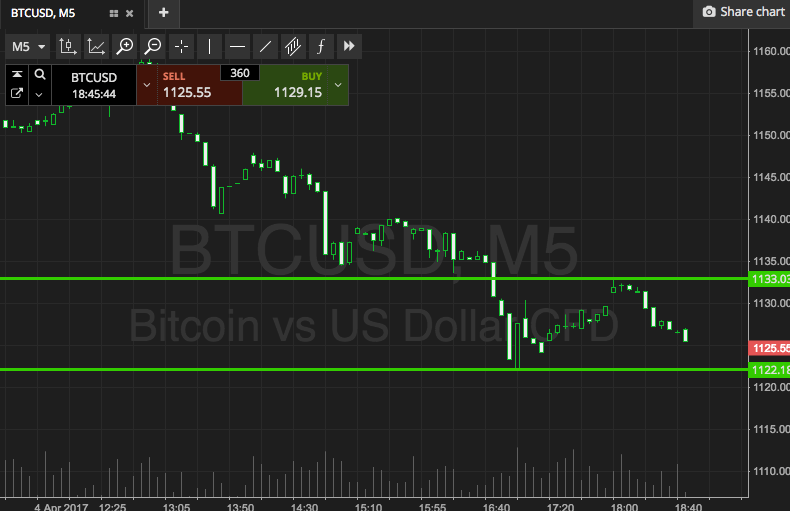

So, that’s what we’re going to do this evening. Take a look at the chart below to see how action matured throughout the European session this afternoon, and to get an idea of where things stand this evening from an intraday trading perspective.

As the chart shows, the range we’re looking at is defined by support to the downside at 1122, and resistance to the upside at 1133. We’re sticking with a breakout strategy only this evening, so if we see a close above resistance, we’re going to get in long towards an immediate upside target of 1145. Conversely, if we see a close below support, we’re going to get in short towards 1110.

Let’s see what happens.

Charts courtesy of SimpleFX