We are now more than halfway through the week and – so far – the market has been pretty good to us. We have managed to jump in and out as per our bitcoin price signals on numerous occasions, with the vast majority of our entries carrying through to profitability. The hope is that this profitability can be maintained as we close out the week during the session today and tomorrow, but with the choppiness we saw overnight last night, we can’t really take anything for granted.

With that said, however, our risk management principles helped us cling onto profitability last night, so with continued enforcement of some pretty tight risk parameters on every trade that we enter, we should have no problem closing out on a high.

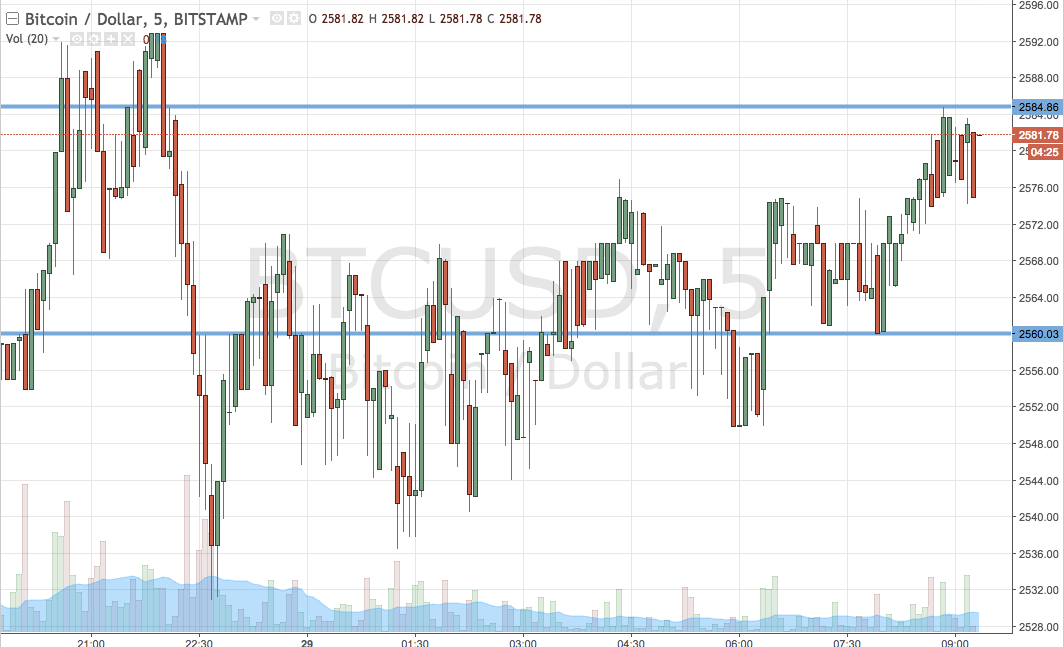

So, in looking at the immediate future, let’s get some levels together with which we can approach the market today. As ever, take a quick look at the chart below to get an idea of where things stand. It is a five-minute candlestick chart (we are going back to the five-minute chart as opposed to the one minute chart, purely because of overnight action) and it has our key range overlaid in blue.

As the chart shows, the range we are looking at today is defined by support to the downside at 2524 and resistance to the upside at 2539. This is a little too tight for an intrarange approach so we will be focusing purely on breakout trades for the time being.

Specifically, if we see a close above resistance at 2539, we will look to enter towards an immediate upside target of 2570. A stop loss on the trade at 2530 will ensure we are taken out of the position in the event of a bias reversal.

Looking short, a close below support will have us in towards a downside target of 2500 flat. A stop loss on this one at 2530 looks good.

Chance courtesy of Trading View