So that’s it for the day – the European markets have now drawn to a close, and it’s time to take a look at the second of our twice daily bitcoin price analyses. We’ve had a pretty rough day from a trading perspective. With this morning’s setup, we looked to get in and out on the breaking of support or resistance, and go after a relatively short term target. A scalp target. Because of our scalp targets, we had to put in place some equally tight risk management parameters, and use these to ensure we got out of the trade in a timely manner if price reversed to trade back within our range. It’s standard procedure, but you always hope the stop doesn’t get taken out.

Well, ours did today.

We got in short on a break of support and our trade initially looked to be going well. Price dropped towards our target, but around the 576 mark started to find support and trade back up to within our predefined range. Our stop was taken out, and we’ve traded sideways since.

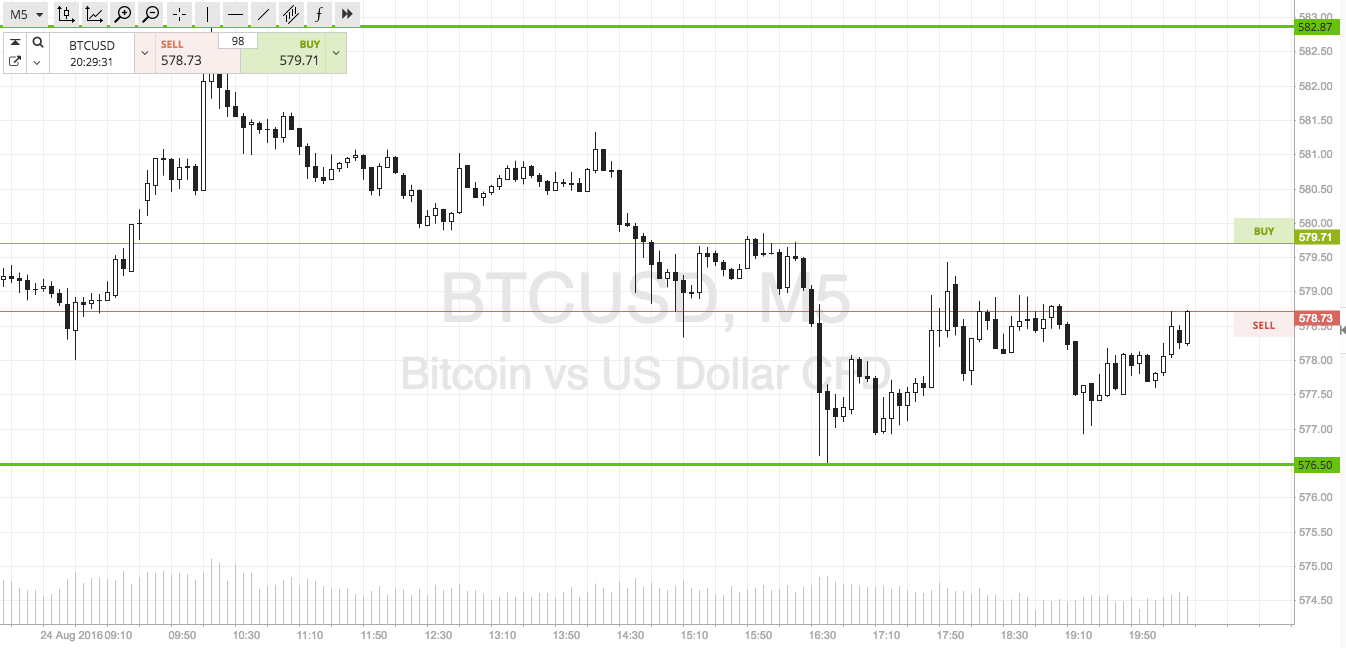

A sliver lining is that it’s given us something to go at this evening, as we can use the new intraday low as a fresh key level. So, on that note, let’s get in to the detail and take a look at our range in focus for this evening. As ever, get a quick look at the chart below to see what’s on.

As the chart shows, the range for tonight is defined by support at 576 (the aforementioned lows) and resistance at 582. If price breaks support, we will get in short towards 570 flat. If it breaks resistance, we will target a long entry towards 587.

As always a stop just the other side of our key levels will ensure we are taken out on a bias reversal.

Happy Trading!

Charts courtesy of SimpleFX