Those who have followed along with our bitcoin price watch pieces over the last few weeks will have noticed a common thread running through our strategy. We’ve been defining relatively tight ranges and skipping in and out of the markets with these ranges on breakout scalp trades. It’s been somewhat effective but there have been some pretty frustrating periods through which we’ve had to sit and stay net flat in the markets. Well, to mix things up a little today, we’re going to alter our strategy slightly. Not in that we are going to veer from our breakout approach, but we are going to define our range al little differently. Specifically, we are going to go after a channel rather than a sideways facing range.

This means we can get in two ways – one in line with the current overarching momentum, and one that goes against the action if we see a reversal. This flexibility should give us some decent entry point as we navigate the European session on the last day of the week.

So, with that said, let’s get in to the details.

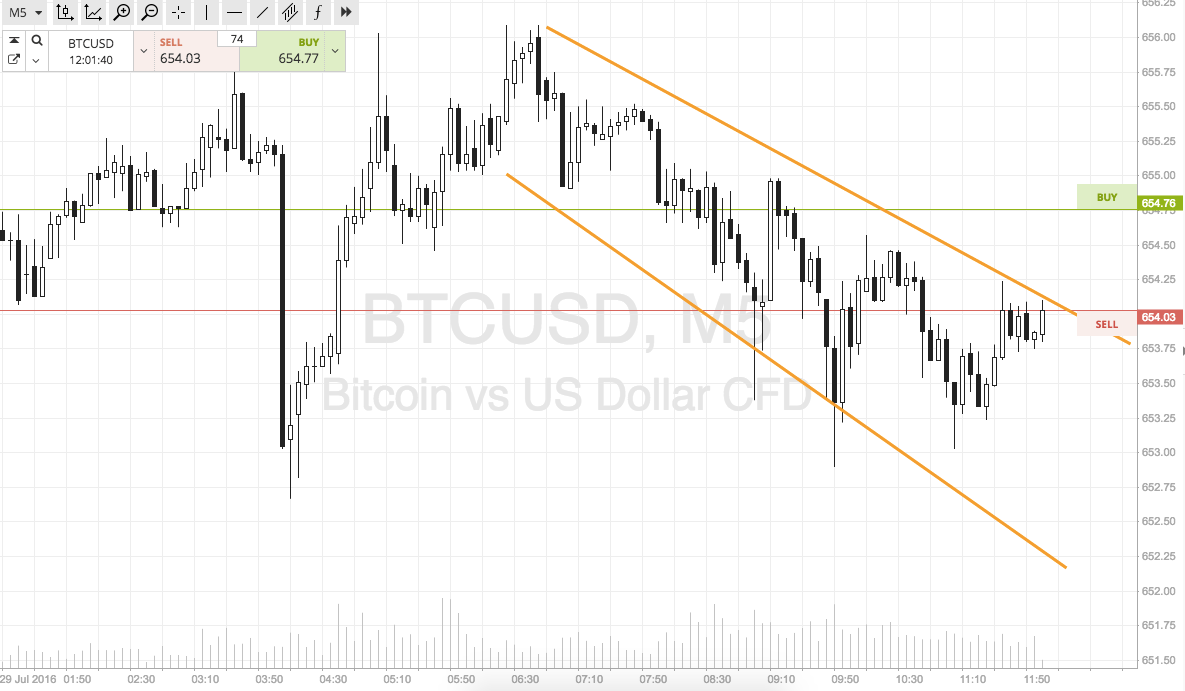

The chart below highlights the range in focus, and shows the action we saw in the bitcoin price overnight. As ever, it’s a five-minute candlestick chart.

As the chart shows, we are looking at a channel defined by support (the lower trend line) at and resistance (the upper trend line). Normally we can be specific as to our entry points, as they are horizontal. In this scenario, however, we don’t know at what point we will be entering – all we know is that if price breaks the channel to the upside we will look to get in long, and if price breaks to the downside we will look to get in short. On each position, we will target a reward of $5, and have a stop loss $2 underneath the entry. Wait for a close above or below to confirm the signal

Let’s see how things play out.

Charts courtesy of SimpleFX