Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

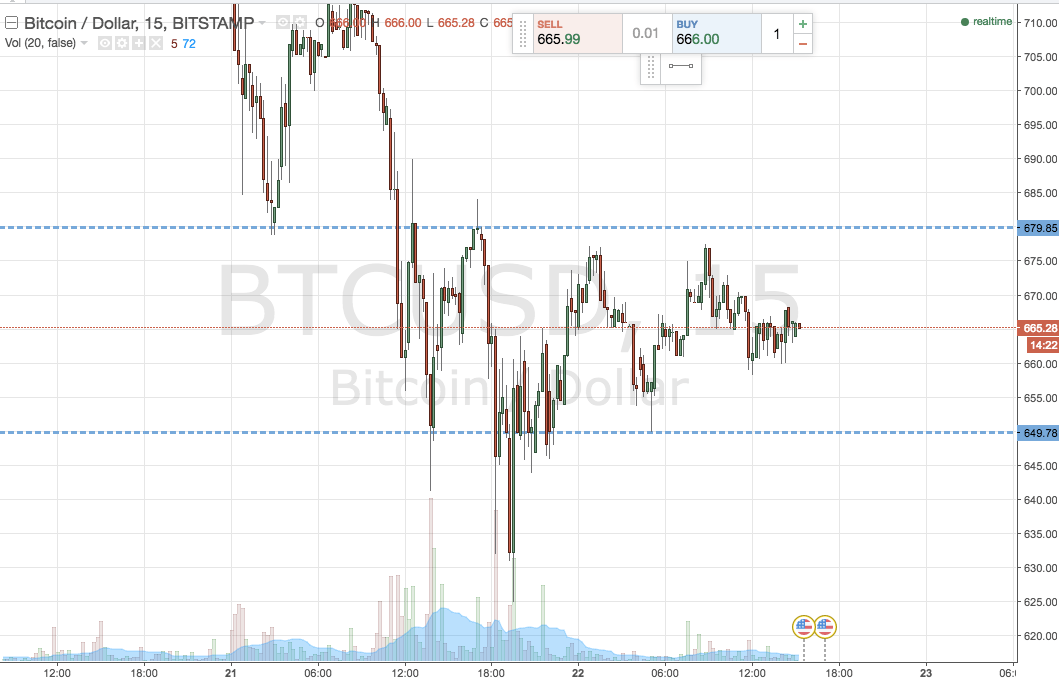

Yesterday, the sharp collapse in the bitcoin price marked the turnaround point in the wider market, and much of the gains registered throughout last week’s session (and this weekend just gone) were given back to the market. Those that sold on a speculative position anywhere between 730-750 made a smart move, and it now looks as though the gains were temporary, as opposed to a long term shift. Fundamentally, it looks as though the downtime at Bitfinex caused the slide, which is both good and bad. Good, because the downtime is not permanent, and is now resolved, so its impact should only weigh on sentiment for a short time. Bad, because it demonstrates the immaturity of the bitcoin space from an asset valuation perspective – if downtime in a single entity related to the space can cause a double digit percentage slip in the valuation of an asset at the core or an industry, there’s still plenty of room for maturation.

Anyway, let’s not dwell too much on that. We’ve got an evening session ahead of us, so what are we looking to trade in the bitcoin price, and where can we set up our range given the recent action? As ever, take a quick look at the chart below to get an idea of what’s on.

As the chart shows, the levels we are focusing on for this evening are in term support to the downside at 641 and in term resistance to the upside at 679. It’s plenty wide enough for intrarange, so long at support and short on a resistance correction.

Looking at breakout, if price closes above resistance we will look to enter long towards an initial upside target of 690. A close below support signals a short entry towards an immediate downside target of 630.

Charts used courtesy of Trading View