To all our American readers, let’s kick things off with a Happy Thanksgiving! I’m guessing volume is probably going to be down a little bit throughout the session today, with the major financials markets shut down across the US, and the early finish tomorrow on the stocks exchanges, but that doesn’t necessarily mean we won’t get any volatility. Sometimes as a result of the low volume we get choppy action, which might make today’s trading a little difficult, but if we set up with some relatively wide stops, and go after some respectively wide targets, then we’ve got nothing to worry about.

So, with this in mind, and as we move forward, let’s take a look at what happened overnight, and where we are heading this session.

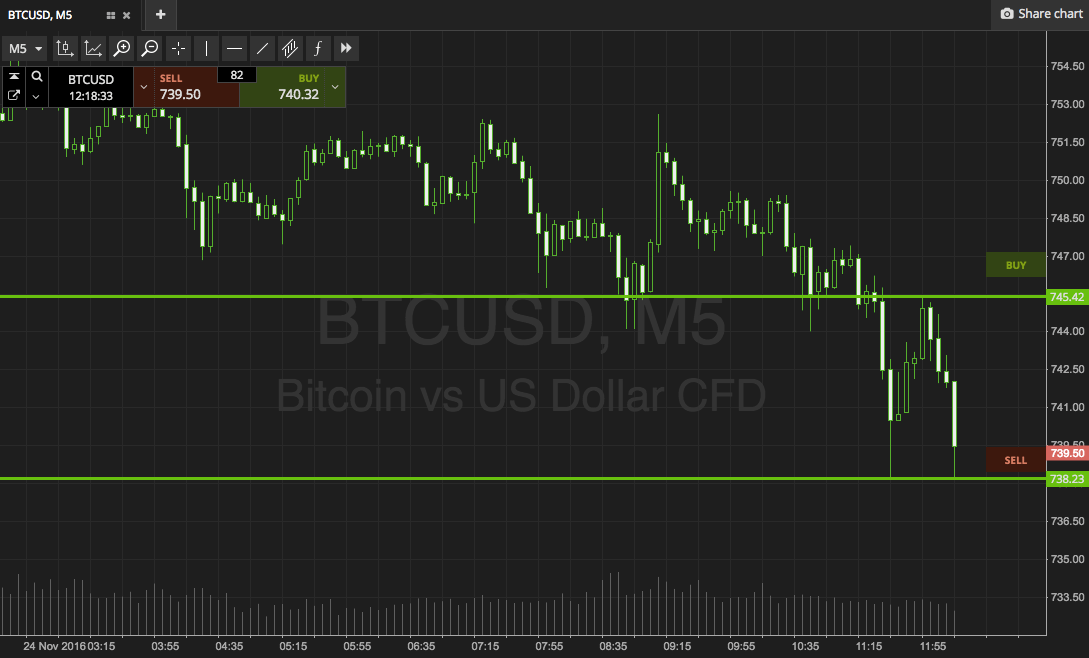

Before we get started, take a quick look at the chart below to get an idea of what’s on.

As the chart shows, the levels in focus for this morning’s early European session are in term support to the downside at 738 flat, and in term resistance to the upside at 754. This is a pretty tight range, so we aren’t going to try ad force anything by way of an intrarange strategy.

Looking at our breakout, then, if we see price cross above resistance, and close above this level, we will look to get in towards 752. A stop loss somewhere in the region of 742 will ensure that we are taken out of the trade in the event of a bias reversal. Conversely, and looking to the downside, if price breaks below support, we will look for a close below this level to give us an excuse to get in short towards an immediate downside target of 730. Again we need a stop on the position, and somewhere in the region of 741 works well to manage our risk on the trade.

Happy trading!

Charts courtesy of SimpleFX