We asked for action in the bitcoin price, and it’s action we got. Things haven’t been this active on the intraday charts for months, and it finally looks like price might make its way through the elusive 700 mark near term. If it does, we expect a considerable upside momentum run as the shorts are squeezed out of the market and price gains on covering. Whatever happens, the action overnight gave us plenty to go at, and we managed to get in and out of the markets according to the rules of our intraday strategy on a number of occasions. Interestingly, and good from both a long term and a short term holding perspective (well, strictly speaking, neutral on the short term side of things, but let’s be optimistic) all entries were to the upside, and all took out the take profits quickly and easily.

So, with some solid gains in our pockets, and as we head into the penultimate European session of the week, let’s take a look at where we are right now, and what we expect from the bitcoin price near term.

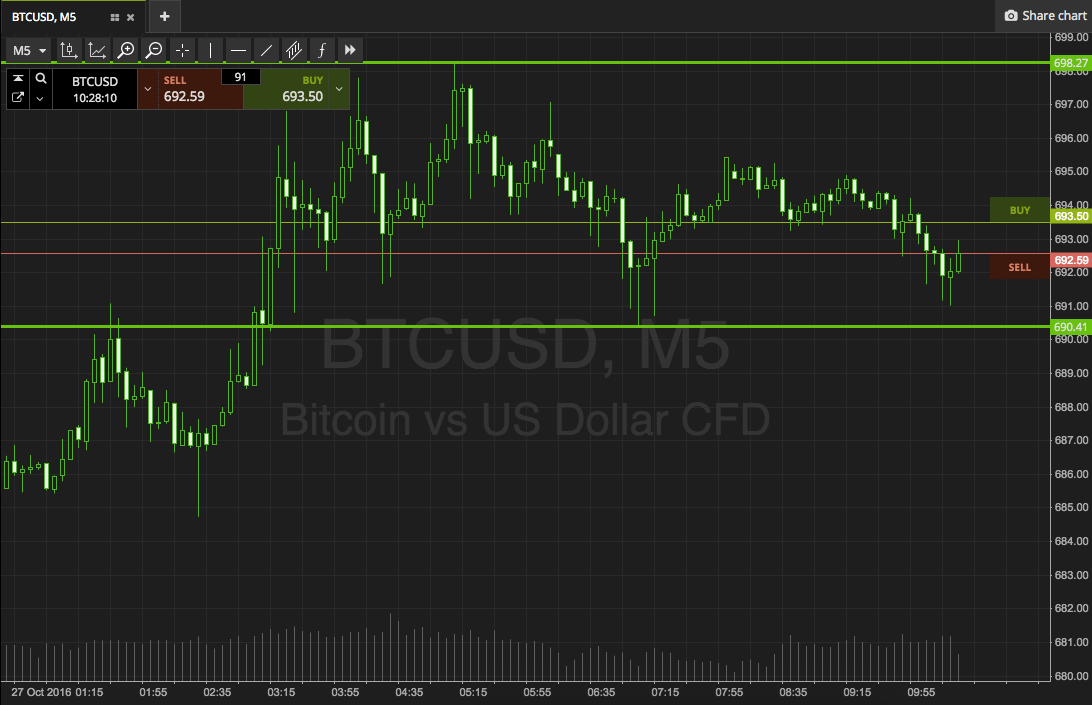

As ever, before we get started, take a look at the chart below to get an idea of what happened overnight, and where we are looking to trade this morning.

As the chart shows, the range in focus for today is in term support to the downside at 690 flat, and in term resistance to the upside at 698. We could be a little more aggressive and go for 700 flat at the resistance side of things, but we may see a correction, so let’s play it safe for now.

If price breaks through resistance and closes above this level (waiting for the close is important here) then we will get in long towards 710. Conversely, a close below support will put us short towards 683.

Let’s see how things play out.

Charts courtesy of SimpleFX