The European session is just about to draw to a close, and it is time to take the second of our twice-daily looks at the bitcoin price. Action throughout the day has been relatively flat, and we haven’t really had any opportunity to get in and out of the markets according to the rules of either our intrarange or our breakout strategies. This isn’t too much of a problem. Sometimes patience is key in these kinds of situations, and as the last few weeks’ worth of trading have shown us, we generally see things start to move before long. Heading into this evening’s session, therefore, our core focus is setting up against any potential volatility, and making sure that – if things do start to move – we are ready to go.

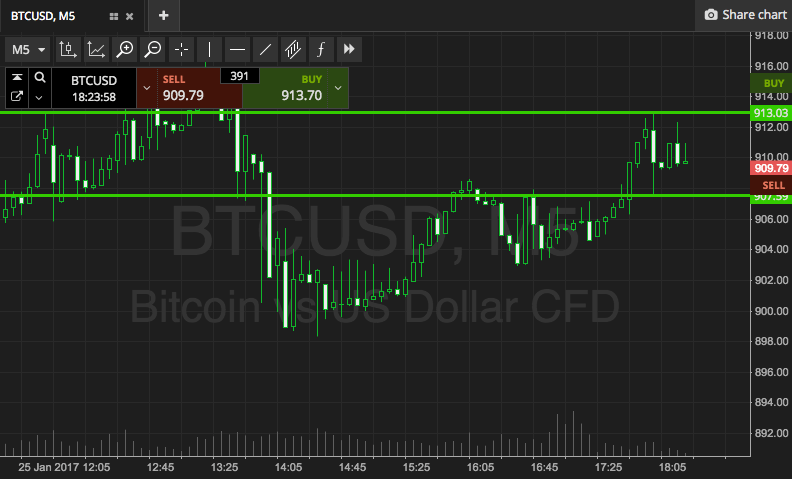

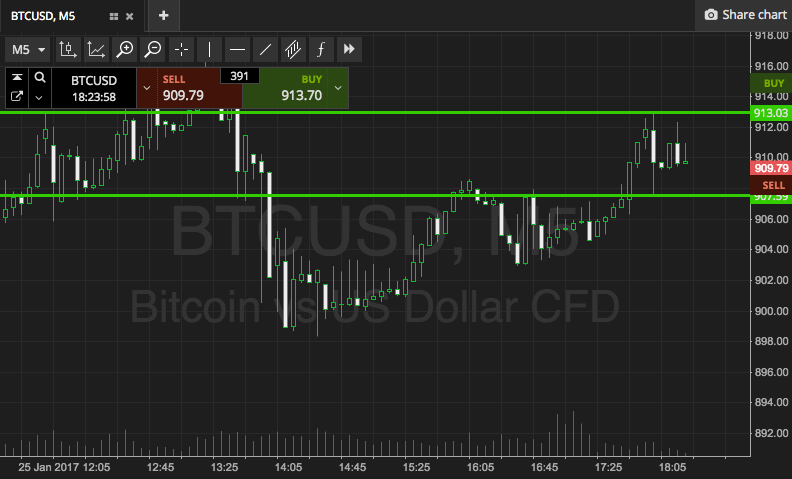

So, with this in mind, and moving into the evening session out of Europe, here are our key levels, and where we are looking to get in and out of the markets according to the rules of our strategy. First up, take a look at the chart below to get an idea of the levels in focus.

As the chart shows, the levels we are using for this evening’s range are support to the downside at 907 and resistance to the upside at 913. This is a very tight range compared to our usual parameters, so we are going to skip our intrarange strategy for now. Breakout only, with a view to taking advantage of some momentum driven breakout volatility.

So, if we see the price break above resistance, we will get in long towards an immediate upside target of 920. Tight range, tight target. A stop loss on the trade at 910 defines risk. Conversely, a close below support will put us short towards 900. Again this is a pretty tight trade, and we need a tight stop loss. Somewhere in the region of 910 looks good.

Charts courtesy of SimpleFX