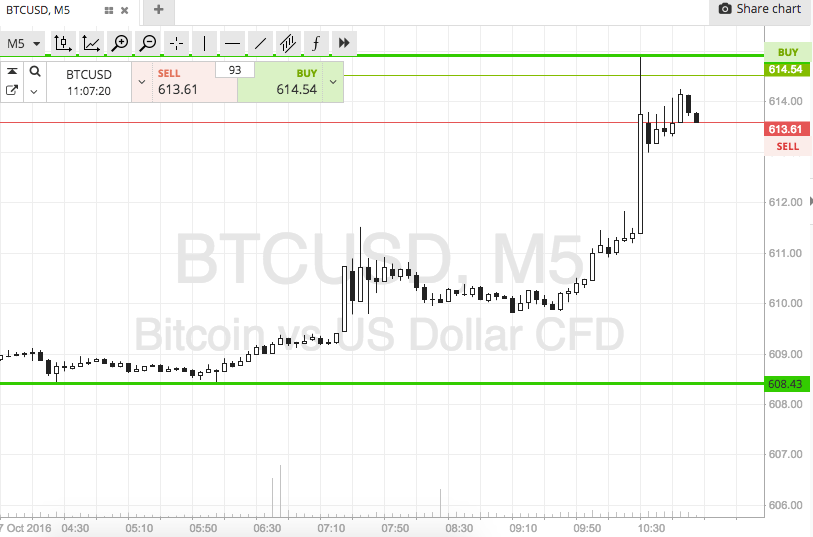

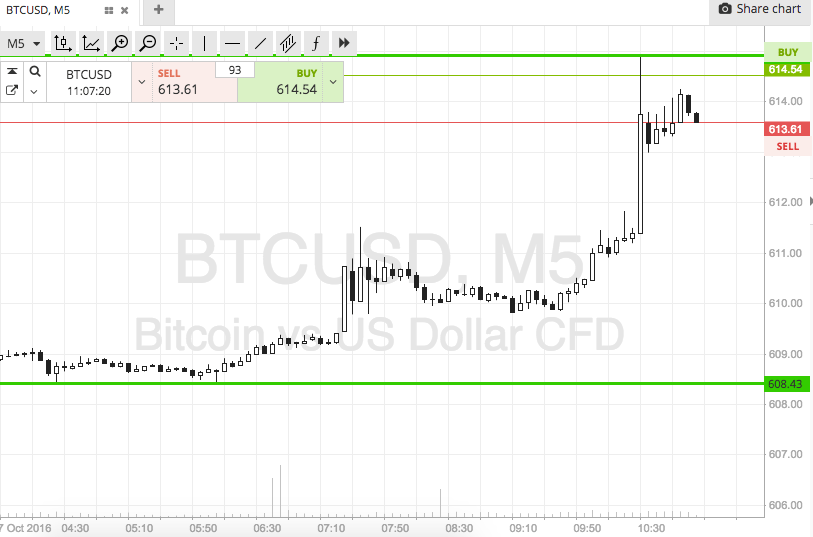

So that is it for another week in the bitcoin price. Things haven’t played out exactly how we might have liked them too, but we did still get the opportunity to get in and out of the markets according to our intraday strategy on a number of occasions. We are going to close out the week with a net profit, assuming today’s session isn’t too much of a disaster from a risk management perspective. It shouldn’t be, so long as we maintain a positive profile on any positions entered. So, with this in mind, and as we head into today’s European morning session, here is a look at the levels in focus, and where we are going to look to get in and out of the markets according to our intraday strategy. First up, as ever, take a look at the chart below to get an idea of overnight action. It is a five-minute candlestick chart with today’s strategy overlaid in green.

As the chart shows, the levels we are focusing on for this morning are defined by support to the downside at 608 and resistance to the upside at 614. This is a pretty narrow range, so we won’t be attempting any intrarange entries for this morning’s session at least. If things widen out this evening, we may take a look at getting in on a bounce, but that is for later.

Looking at our breakout strategy, if price breaks above resistance, we will look for a close above resistance to validate an immediate upside entry towards an initial upside target of 620. A stop loss on this position somewhere in the region of 612 works to define risk on the trade. Conversely, if price breaks below support, a close below this level will signal short towards 602. Again we need a stop loss, and somewhere around 610 looks good.

Happy Trading!

Charts courtesy of SimpleFX