So, we are a little into the Europeans session on Wednesday, and it’s been an interesting week so far. Things have been up and down, and we’ve been chopped out a couple of times, but we’ve also managed to get in and out according to our intraday strategy for some nice wins.

Midway through the week is where we start to look towards the close of play, and see how our net position is looking likely to play out. Things look ok right now for a weekly net gain, so we are going to go for a real tight range on the session and see if we can’t scalp a couple of tight profits this afternoon and bring us a little bit closer to a positive bottom line end of week. So, with that said, let’s take a look at our key levels, and define some entry and exit points for our positions.

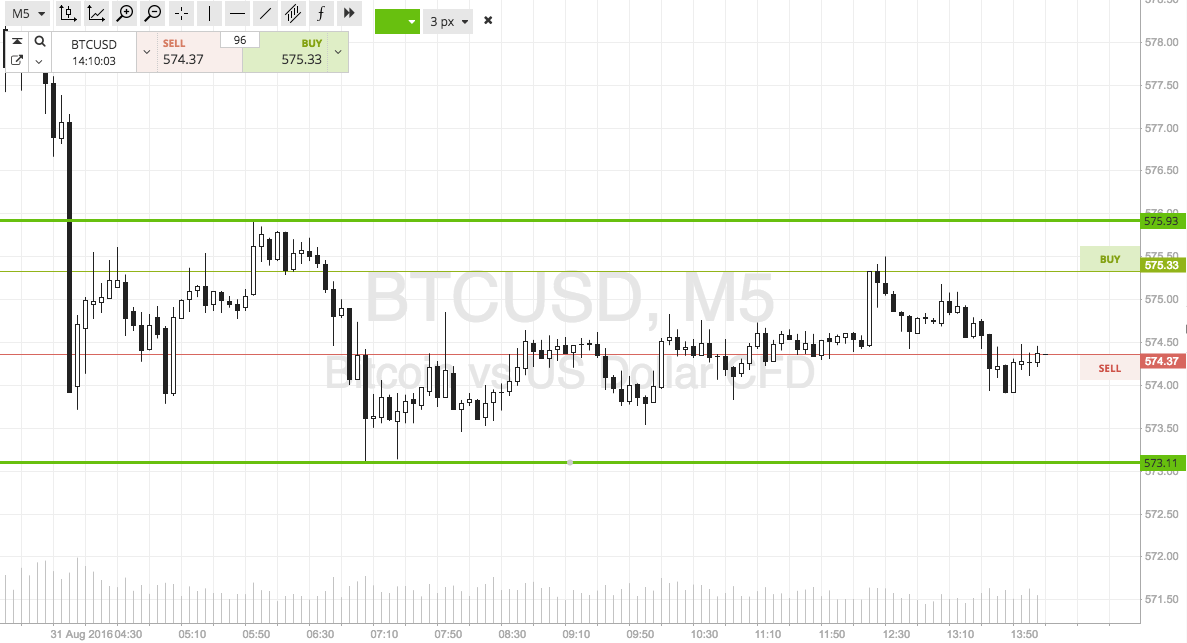

Before we get into the detail, take a look at the chart below to get an idea of the range. We’ve got the bid ask lines (highlighted as buy and sell on the chart) in view, so as to illustrate the necessity for our risk/reward placement and to justify our decision to stay away from an intrarange approach for now.

So, as the chart shows, we are focusing on in term support to the downside at 573 flat, and in term resistance to the upside comes in at 576 flat. This range is probably the tightest we are able to go on these intrarange charts, so we aren’t going to be looking for anything spectacular from a reward perspective. Short and sweet is the name of today’s game.

If price breaks above resistance, we will get in long towards an immediate upside target of 580 flat. Conversely, a close below support signals short towards 568. A stop just the other side of the entry defines risk on both trades.

Charts courtesy of SimpleFX