OK, we’re going to tighten things up a little this evening and go at price in a slightly different way. Those familiar with the last few days’ worth of action in the bitcoin price won’t need to ask why. Those new to this strategy approach, we’re basically coming off the back of three days of flat action, and while we’ve had a couple of opportunities to get in to the market, nothing has been sustained (in the sense that a breakout has been short lived as and when it’s materialized) and our profits – while there – have been minimal.

For this evening’s session, therefore, as the US afternoon gets underway and as Europe closes down for the day, we’re going to bring our levels in, change up our time frame, and jump in and out of the markets using a short term scalp strategy.

We’ve tried this approach in the past when action has consolidated like it is doing right now, and it makes things a bit more interesting.

So, here goes.

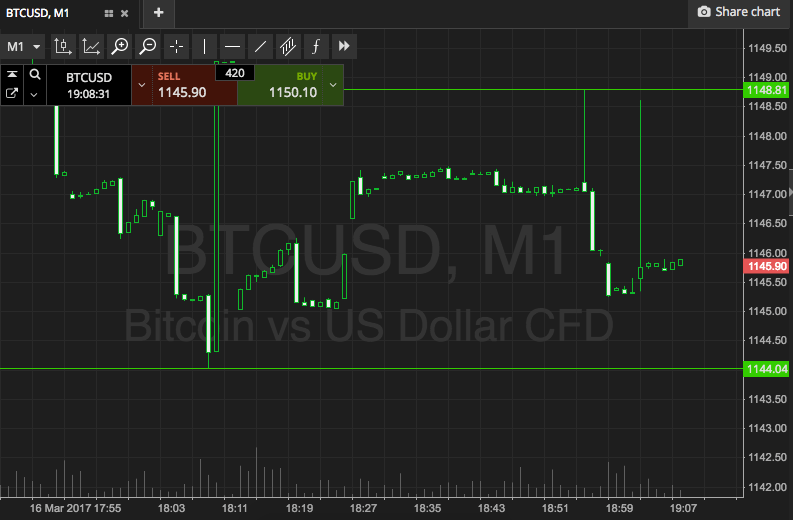

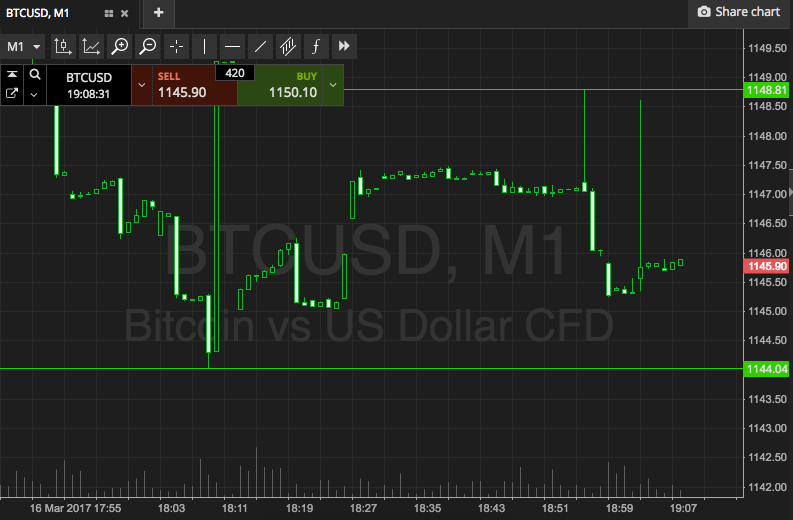

Take a look at the chart below to get an idea of what’s on, and where we are looking to get in and out of the markets according to the rules of our intraday strategy this evening. It’s a one-minute candlestick chart and our key range is overlaid in green.

As the chart shows, the range we are going for is defined by support to the downside at 1144, and resistance to the upside at 1148. If we see price close above resistance, we will look to get in long towards an immediate upside target of 1154. A stop at 1146 defines risk.

Conversely, a close below support will put us in short towards 1138. A stop at 1146 kills risk on the position.

Let’s see how things play out and we’ll freshen up tomorrow morning if required.

Charts courtesy of SimpleFX