Here we go on another day of trading in our bitcoin price efforts and it’s time to get some levels in place that we can use to try and draw a profit from the market if and when things move.

Things have slowed down a little in terms of outright runs over the last few days and we’re guessing that this is symptomatic of nothing more than a bit of profit taking on the back of last week’s run.

Whether we will see a return to the exciting moves we saw at the end of last week as we head into the close of this one remains to be seen but – as is almost certainly the case – there’s a strong chance that the majority of those with any sort of stake in this market are doing exactly that.

Anyway,

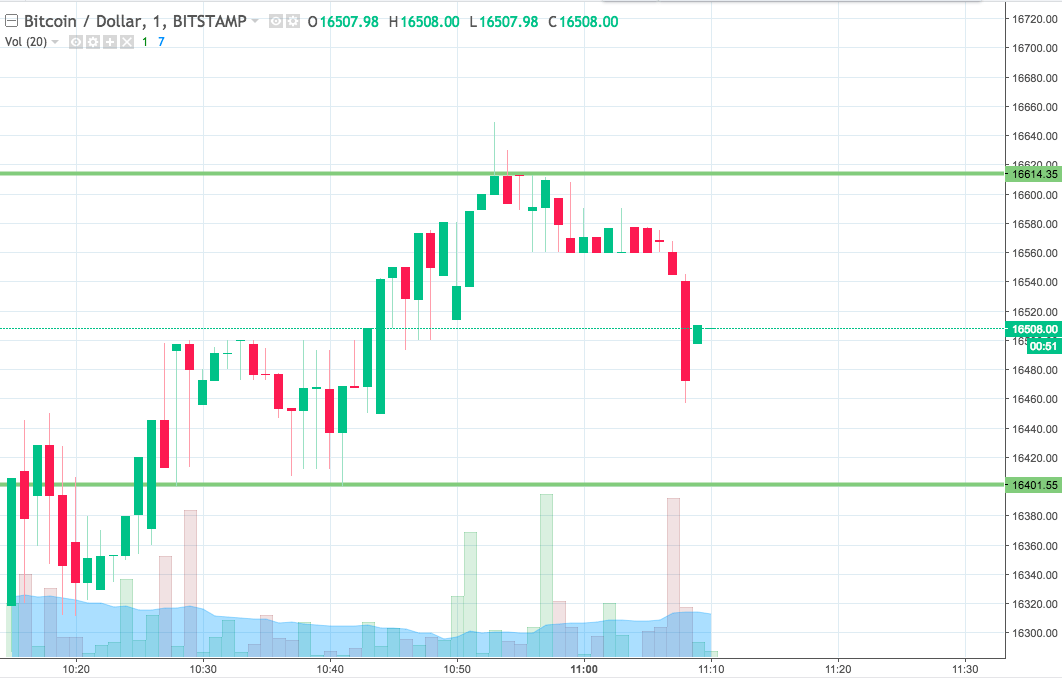

Let’s try and get some levels in place that we can use for the session going forward and see if we can get in and out of the markets whatever happens. As ever, take a quick look at the chart below before we get started so as to get an idea where things stand right now. The chart is a one-minute candlestick chart and it’s got our key range overlaid in green.

As the chart shows, the range we are looking at for the session today comes in as defined by support to the downside at 16401 and resistance to the upside at 16614. If we see price close above resistance, we’ll jump in long towards an immediate upside target of 16700. A stop at 16580 looks good on the trade.

Looking the other way, a close below support will have us in short towards 16320. A stop on this one at 16420 works well from a risk management perspective.

Let’s see how things play out.

Charts courtesy of Trading View