This morning we noted that action in the bitcoin price was perfect for going at the markets with an intrarange, intraday strategy. We discussed the fact that price seemed to have held pretty flat between two key levels for the last few days, and that by going after these two levels on a bounce/correction strategy might be our best option. As it turns out, we were right. Action has now matured throughout the day, and we managed to get in and out of the markets a couple of times for an intrarange profit based on our key levels as predefined this morning.

We are about to head into the close of the session, however, and move into the US evening and beyond into Asia. Things might change if we get a kick in volume from the Asian markets, so we’re going to reevaluate our key levels a little to ensure we stand a chance if volatility picks up.

With this in mind, here’s a look at the focus levels for this evening’s session, and where we will look to limit our risk on the trades.

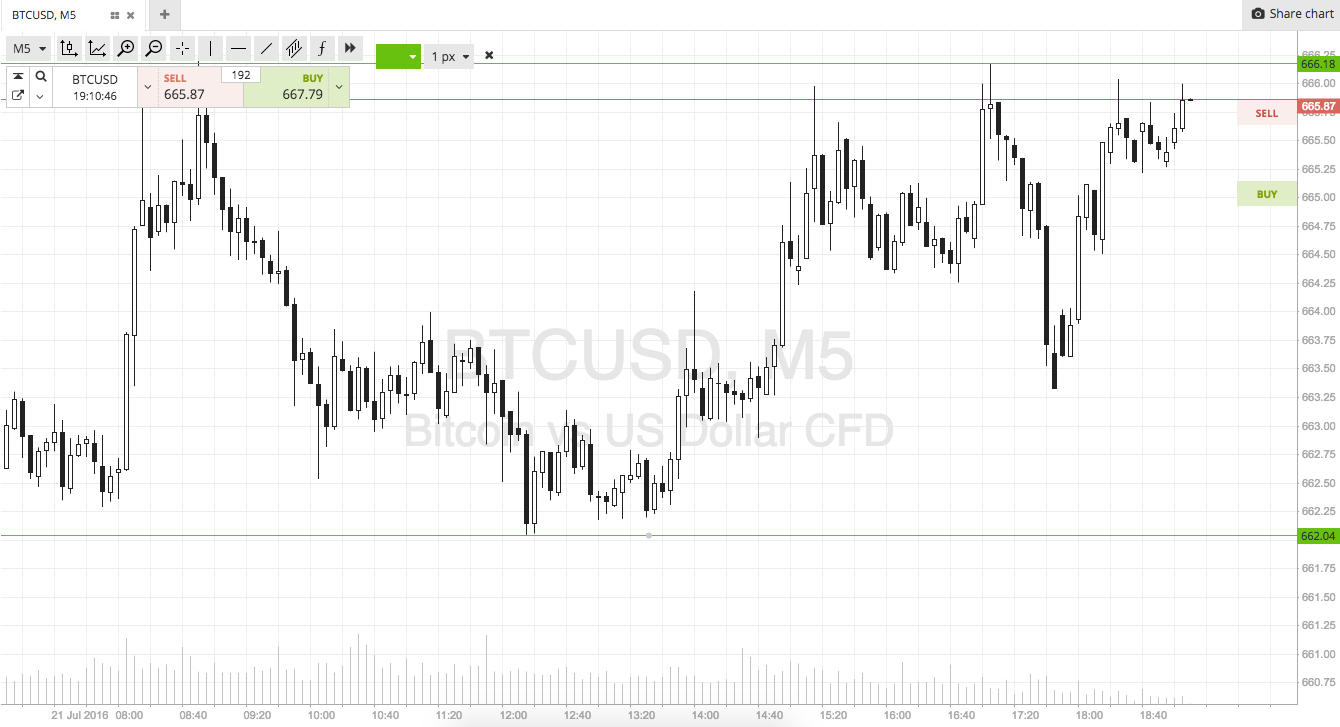

As ever, take a quick look at the chart below to get an idea of what we are focusing on. It’s an intraday chart with a five-minute timeframe, with our key levels highlighted in green.

As the chart shows, we are shifting our range in focus so as to define it by in term support to the downside at 662, and in term resistance to the upside at 666 flat. It’s a super tight range, so we are going to go for a breakout strategy only tonight.

Specifically, if price breaks resistance we will enter long towards 672 to the upside. If price breaks support, we will get in short towards 655. Stop losses just the other side of the entry will define risk.

Charts courtesy of SimpleFX