Things are moving incredibly fast in the bitcoin price right now so, just as we did this morning, we are going to jump straight into our analysis so as not to miss any opportunities for entry on the action that we are seeing.

Anybody that is watching the space in real time will know that online wallet provider Coinbase is experiencing some difficulties with Litecoin and Ethereum transactions and this is translating to some immediate downside pressure in the bitcoin price, purely based on the fact that it exposes the relative youth of even one of the biggest companies in this sector as far as dealing with increased volume is concerned.

That’s the fundamental side of the equation.

Forgetting that for now, however, let’s get levels in place that we can use going forward and see if we can take advantage of even the downside action.

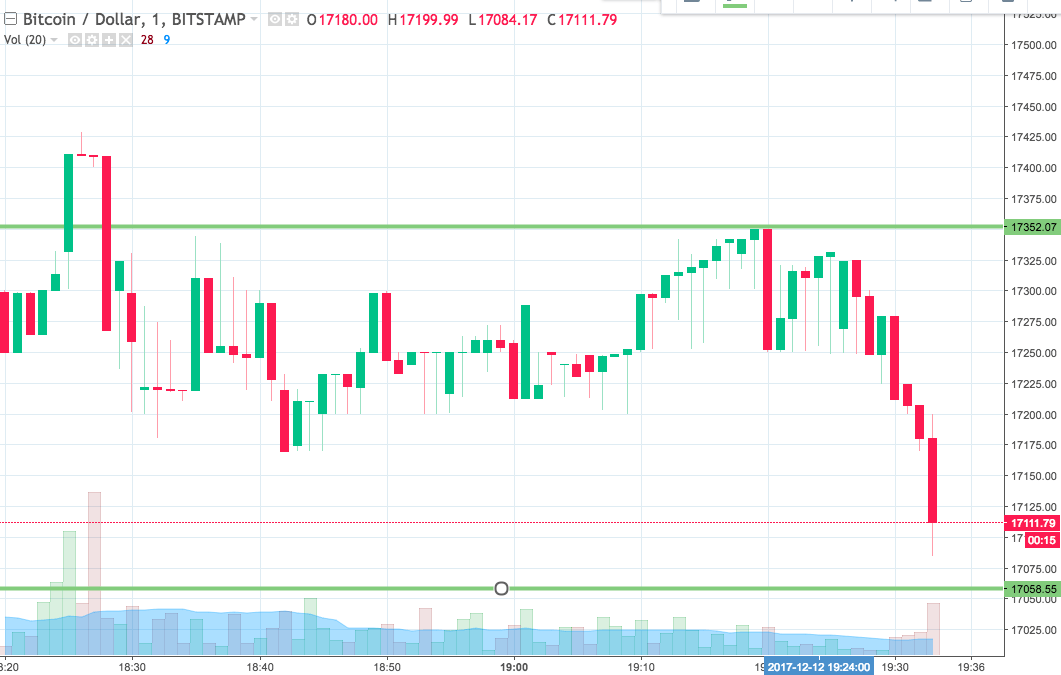

As ever, take a quick look at the chart below before we get started so as to get an idea where things stand and where we are looking to jump in and out of the markets according to the rules of our intraday strategy. The chart is a one-minute candlestick charting and it has our primary range overlaid in green.

As the chart shows, the range that we are looking at for the session this evening comes in as defined by support to the downside at 17058 and resistance to the upside at 17352.

Standard breakout rules apply going forward.

Specifically, we will look at entering a long position if we get a close above resistance with a stop loss at 17320 and a target at 17410.

Looking the other way, if price closes below support, we will enter short towards 17000 and a stop loss somewhere in the region of 17075 will ensure we are taken out of the position if things turn against us.

Chart courtesy of Trading View