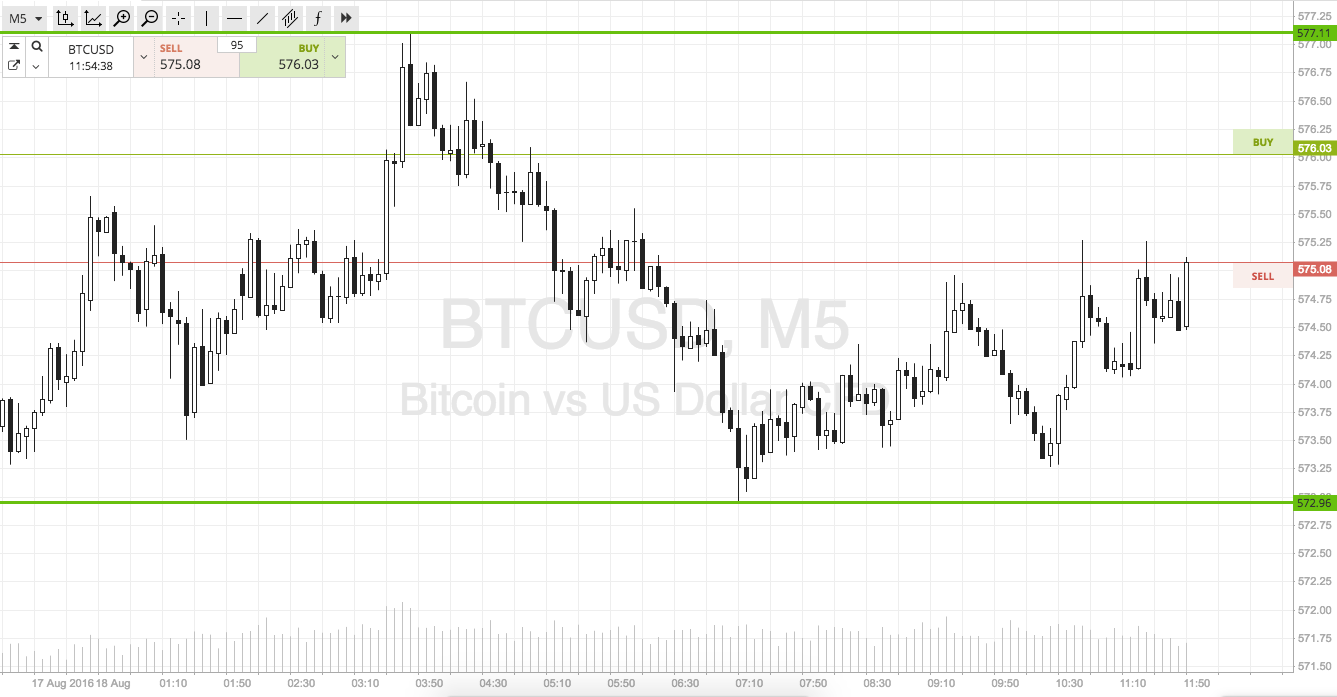

So today we’re going to do something a little different, and focus on intrarange action as a primary strategy in our bitcoin price trading. Normally we set up our range based on the potential for breakouts, and enter short term scalp trades towards relatively tight targets when price breaks and closes above the levels that define the range. Instead of doing that today, we are going to widen out our range a little bit and look to enter on any internal reaction to price hitting the levels in question. So, as get started on this fresh European morning, here is a look at what we’re going for, and where we will look to get in and out of the markets according to our intraday strategy rules. As ever, take a quick look at the chart below to get an idea of the levels in focus, and see what happened overnight in the bitcoin price during the Asian session.

As the chart shows, we are currently trading midrange between our predefined range of support to the downside at 572 and resistance to the upside at 577. It’s not that wide a range, and normally wouldn’t be enough to give us an intrarange strategy, but as long as we keep our risk tight, the bid ask spread should be just narrow enough to let us get in and out on a positive risk reward profile.

Specifically, if price hits resistance and then corrects to the downside, we will enter a short trade towards support as an immediate downside target. A stop loss just above resistance, somewhere in the region of 578 of 579 will help us to maintain a positive risk reward profile in the trade. Conversely, if price bounces from support, we will get in a long entry towards resistance. Again we need a stop loss, and somewhere in the region of 571 looks good on this one.

Charts courtesy of SimpleFX