We have come to the end of the day in our bitcoin price trading efforts out of Europe and it’s time to take stock of how things played out during the session in an attempt to formulate a strategy that we can carry forward into the session this evening. Any readers that caught this morning’s coverage will know that we were looking for a return to the longer-term upside momentum throughout the session today. As it turns out, we didn’t get any real upside, and price has actually dipped a little on this mornings levels. It’s not a major dip and there’s a good chance that – as the US session takes over and volume increases – things will pick up again. However, it did fall against our expectations and this has meant we have had to be a little bit tighter than we initially hoped with our risk management.

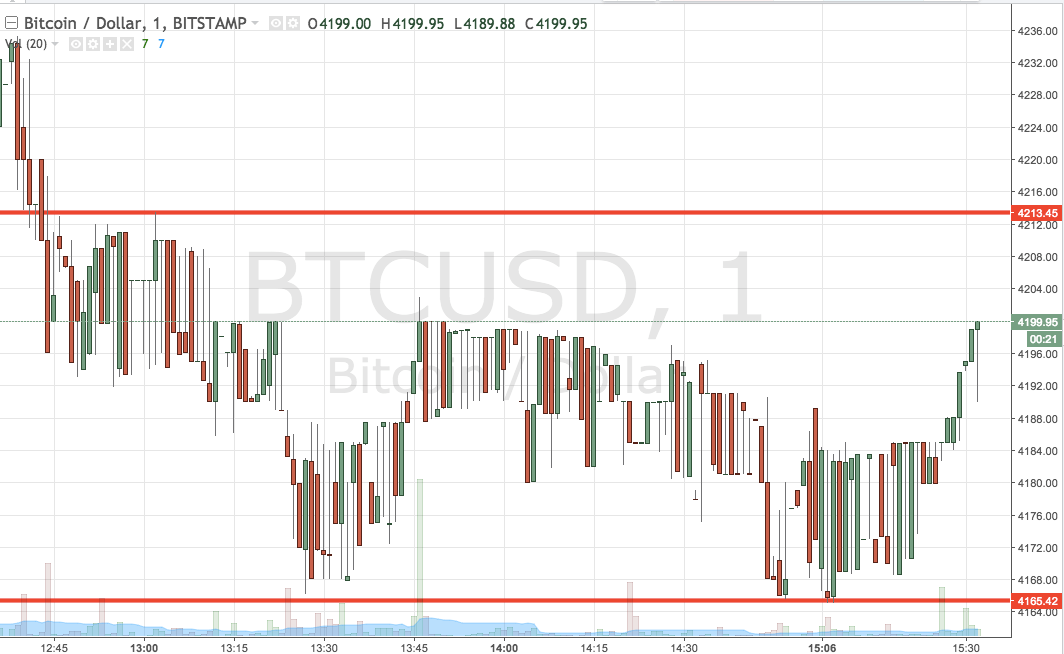

Anyway, that is done now. Let’s get some levels in place try to draw profit from the market near term. As ever, take a quick look at the chart below before we get started so as to get an idea of where things stand and how action today has played out. It is a one-minute candlestick chart and it has our key levels outlined in red.

As the chart shows, the range we are looking at for the session this evening is defined by support to the downside at 4205 and resistance to the upside at 4249. We will initially look for a close above resistance to validate an upside entry towards a target of 4300. A stop loss on this trade at 4235 looks good. Looking the other way, and as relates to a short entry, a close below support will have us in to the downside towards a target of 4170. A stop loss on this one at 4215 looks good.

Chart courtesy of Trading View