Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

It is Tuesday morning, and the European markets are about to kick off for the day. As usual, head of the markets, here is a look at how the bitcoin price is open, and how we are going to use this movement to create a strategy for today’s session. First, then, let’s have a quick look at overnight action.

The first thing worth noting is that we finally saw some upside momentum in price last night. For the past couple of months, Christ has pretty much stayed constrained within a tight range of between the very high 500s and the very low 600s. This has limited our trading opportunities somewhat, and has been a little bit frustrating for an intraday perspective. Last night, however, we got a sharp upside move, and price has moved to its highest levels of the quarter so far. We are going to use this break to outline our key levels going forward into this morning’s session, and likely beyond, if we get a period of consolidation.

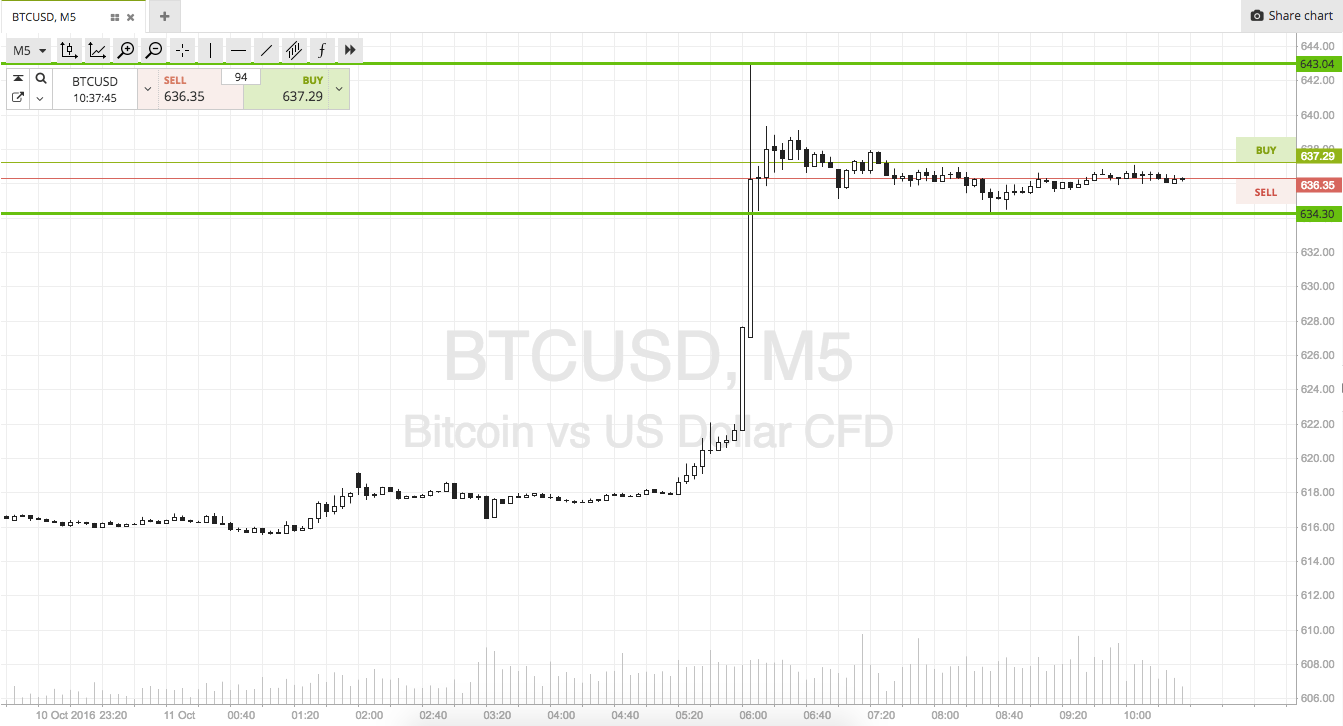

So, with that in mind, take a look at the chart below to get an idea of where we are looking to get in and out of the markets on any more volatility.

As the chart shows, we are looking at support to the downside at 634, and resistance to the upside at 643. This is plenty wide enough for a range bound strategy, so, long support and short systems, targeting the opposing lHimevels on the entry.

Looking at breakout trades, if Christ breaks below support, we will aim to enter short towards an immediate downside target of 627. A stoploss on the position somewhere in the region of 638 defines risk nicely. Looking north, a close resistance will put us long towards 650. A stoploss in this one at 640 will enable us to keep on top of our risk.

Charts courtesy of SimpleFX