It’s that time of the day again, as the European session draws to a close and the US afternoon kicks off. Volume generally picks up a bit around this time, and with this added volume will often come a bit more volatility. In anticipation of this volatility, let’s take a look at what’s on this evening. First, what did action this morning tell us about what’s set to play out going forward?

Well, in this morning’s analysis we noted that price had shot up overnight, and that this gain mirrored the gains we saw earlier on in the week that took us through the 700 flat mark. This time, of course, the gains took us to fresh highs, circa 250 flat. We also noted that, based on the similarity of the movement, we might see a medium term correction. Indeed, we did get this correction, and things have remained pretty much flat since.

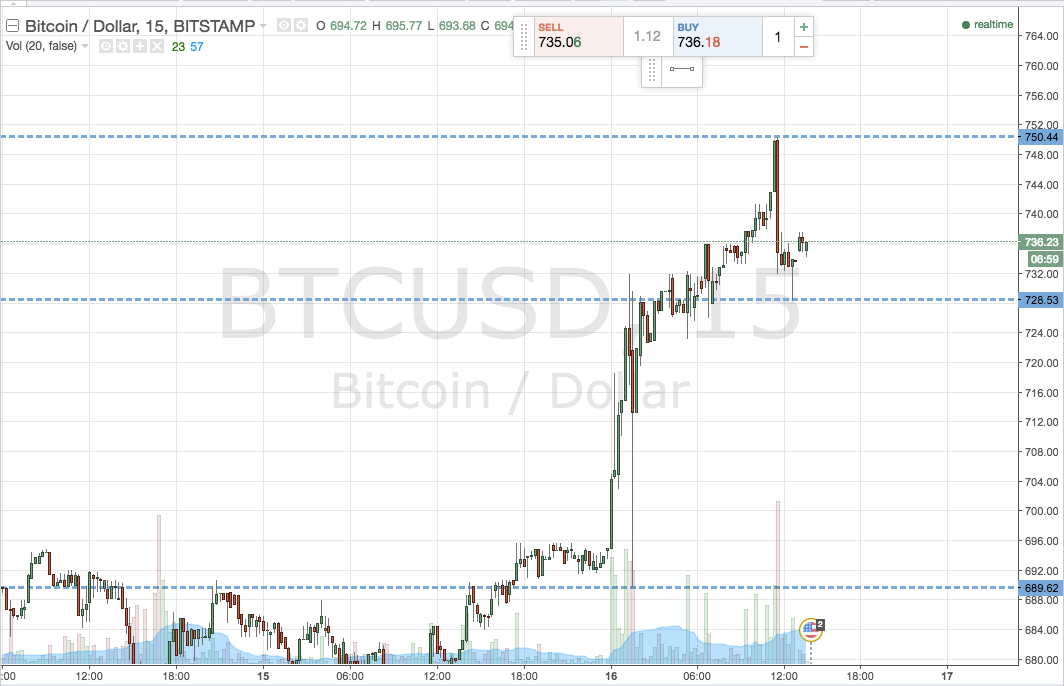

So, with that said, what are we looking at as this play out tonight? As ever, take a quick look at the chart below to get an idea of what’s on, and to see the range in focus for this evening. The chart is a fifteen-minute timeframe candlestick chart.

So, as the chart shows, the range in focus is defined by in term support to the downside at 728, which is the lowest swing point on the recent correction, and resistance to the upside at the most recent swing high, which also represents the intraday high, at 750 flat.

We are going to play breakout only this evening, so no intrarange strategy for now. Specifically, we will look to enter long on a close above resistance towards an initial upside target of 760 flat. A stop at 744 defines risk.

A close below support signals short towards 720. Stop at 732 to keep risk tight.

Charts courtesy of Trading View