Another day done in our bitcoin price trading operations, and it’s been a pretty interesting one. This morning we noted that we hadn’t seen too much volatility early week, and that in the absence of this volatility, getting in and out of the markets has been a little tough. We also noted, however, that this isn’t necessarily a bad thing. It’s a bit frustrating (things are far more exciting when we’re chasing a profit target) but it means we aren’t looking at any losses, and pretty much every time we run through a period of down time we get more than enough opportunity to get back in to the markets shortly thereafter.

Well, the European session today has started to pick up, and we’ve managed to proved the above theory once again.

We got in long on some solid upside action, and in doing so, drew a decent profit from the market on the volatility served up.

Now, as we head into the late session, tonight, let’s see if we get more of the same, and more importantly, if we can take advantage of it and pull more profit out of the market.

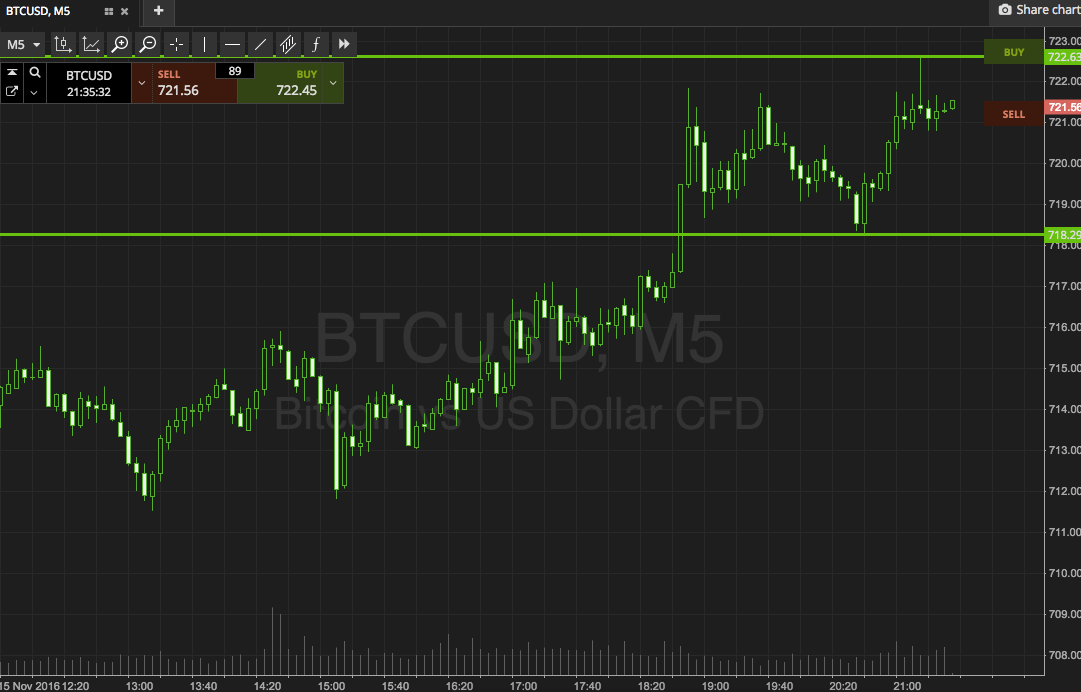

Take a look at the chart below to get an idea of what’s on.

As the chart shows, the range in focus for this late evening session is defined by in term support to the downside at 718 flat, and in term resistance to the upside at 722 flat. This is a super tight range, so we’re definitely just going after breakout scalp trades for the time being.

Specifically, if we see price break through in term resistance to the upside, we will get in long towards an immediate upside target of 726. Conversely, a close below support will put us short towards 713. Stops just the other side of entry (around two dollars either side) will ensure we are taken out of the trade in the event of a bias reversal.

Charts courtesy of SimpleFX