There we go then, the end of the week is here, and it’s been a pretty dull experience. Price stayed relatively flat throughout the first half of the week, with the breaking of our 1100 support coming in as the only real key event of note, and we’ve had a lot of consolidation type action. This action can be fine, and it can serve up some pretty decent entry opportunities, quick profits, etc., but it’s not that exciting to execute on.

As the week has drawn to a close, fundamental factors have come into play a little more, and we’ve seen price take a real hit on the potential for a hard fork. The implications on price remain unclear, and so many traders and holders are limiting risk by converting some or all of their holdings to cash, and the sell off that underpins this conversion is resulting in some weakening of price.

How this will play out going forward is a little unclear. Chances are, we’ll see a bit more weakness going forward. Risk aversion is king in these sorts of environments, and in many ways, rightly so.

We can’t complain about it, and we’re not going to. What we can do, though, is set up against it, and take advantage of it as and when it plays out.

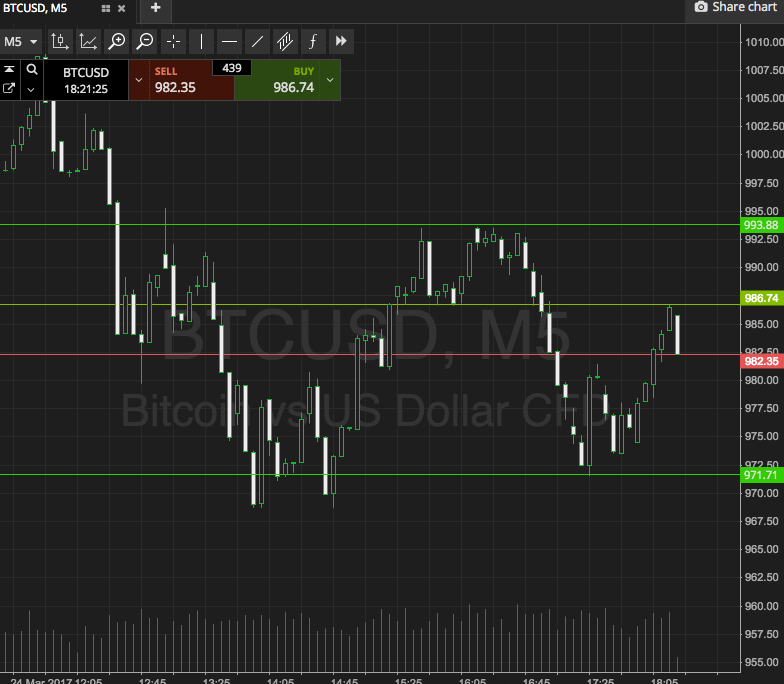

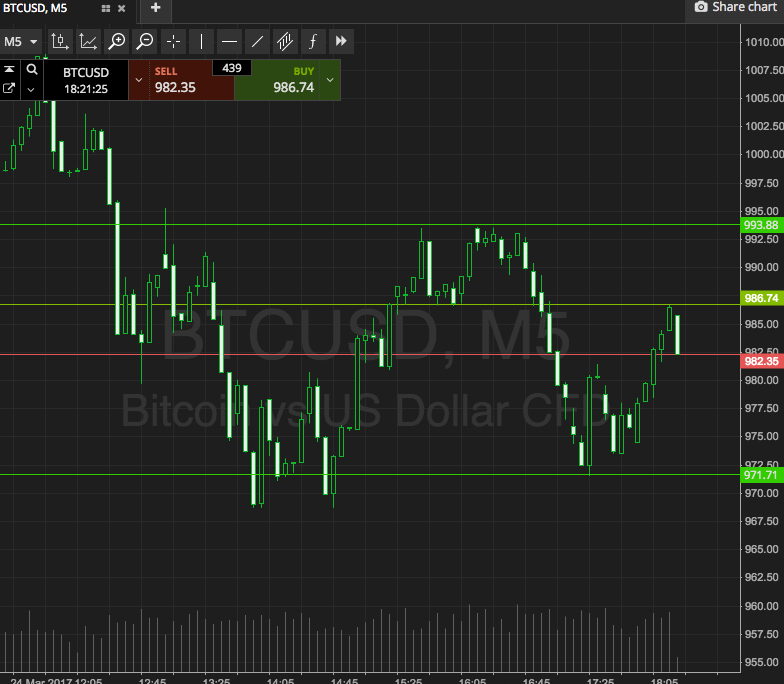

So, take a look at the chart below. It’s got our key levels outlined in green and it’s a five-minute candlestick chart.

As the chart shows, the range in focus is defined by support to the downside at 971 and resistance to the upside at 993. We’re going for breakout only, so we’ll look to get in long towards an immediate upside target of 1010 on a close above resistance, and in short towards a downside target of 960 on a close below support.

As the chart shows, the range in focus is defined by support to the downside at 971 and resistance to the upside at 993. We’re going for breakout only, so we’ll look to get in long towards an immediate upside target of 1010 on a close above resistance, and in short towards a downside target of 960 on a close below support.

Charts courtesy of SimpleFX