So the week has finally drawn to a close, and it’s been an exciting last day to be in the bitcoin price markets. Things have been pretty volatile, and we ended up getting in and out on a quick gap up (unfortunately, for a loss) and the same action occurred same the downside, although the downside entry didn’t materialize based on some well placed (lucky?) resistance placement.

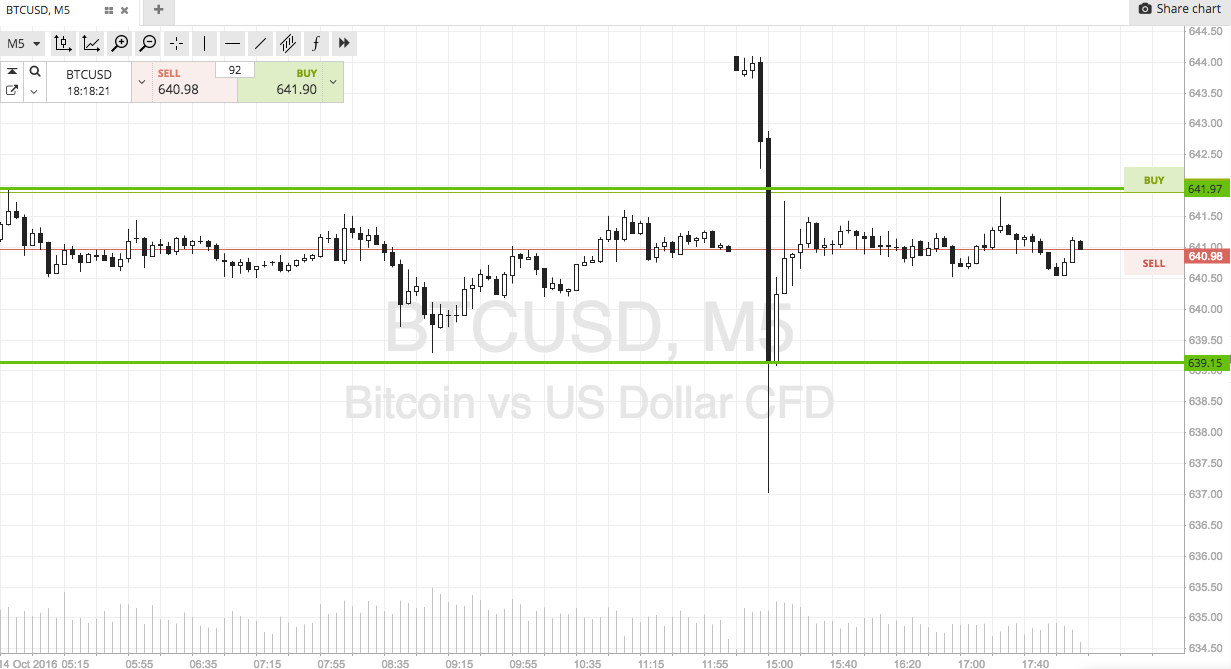

We are about to head into the close of the US session, and we’ve got a little bit of room on either side of price to play with as far as our pre-established key levels are concerned, so let’s see what we can do with tonight’s action. Before we get going, take a look at what happened today on the chart below. It makes for a pretty interesting view!

So the chart shows price gapping up through resistance, and then pretty much reversing the instant the gap candle closed. We got in long on the gap up, of course, which turned out to be an ineffective entry as priced returned to trade back within our prespecified range very quickly. The spike then came to the downside, but we didn’t get in there because price never closed below support (there is a method to our madness!)

Anyway, looking at tonight’s session, we are holding support and resistance as they are, with support to the downside at 639 flat and resistance to the upside at 642. Again we are going at price with a breakout scalp approach only, so long on a break above resistance towards an immediate upside target of 647, and short on a break below support with a target of 632.

We need a stop loss on both positions, and two dollars just the other side of the entry on both counts works well for the sort of reward on offer.

Happy trading!

Charts courtesy of SimpleFX