So it’s Tuesday morning, and after yesterday’s first presidential debate in the US, there’s every chance we will see some level of increased volatility in the bitcoin price as we head into the European open this morning. When the US kicks off for the day, we’ll probably see this volatility amplify.

Exactly how things will play out remain uncertain – the implications of political uncertainty on an asset like bitcoin are just that – uncertain – but our best bet is risk rooted. Uncertainty pretty much only ever leads to a reduced risk tolerance, and risk off sentiment translates to a shift from the risk on asset classes to the risk off asset classes.

For a couple of years now, we’ve been painting bitcoin as having the potential to fall well within the realms of the latter. Just like gold, we expect bitcoin to rise on the back of uncertainty, which gives us something of a bullish longer term bias (4-6 months and beyond).

Today, of course, we’re going to stick with the near term. We’ll kick things off with the European session and see how price plays out from there on in.

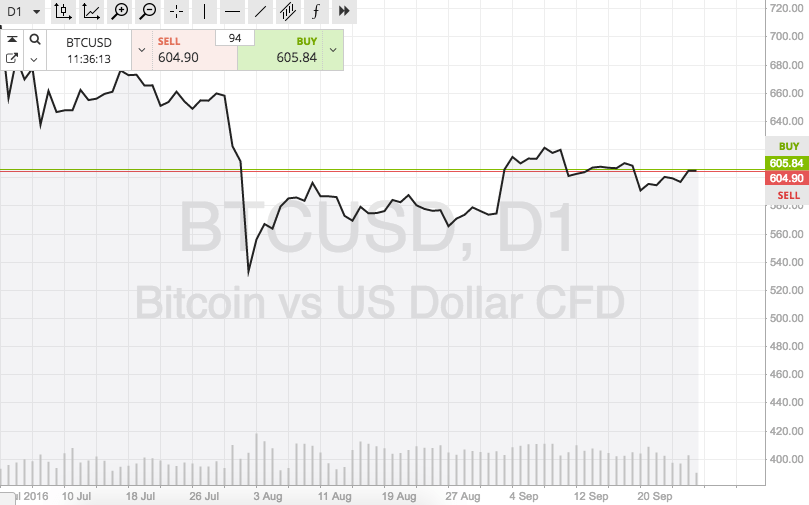

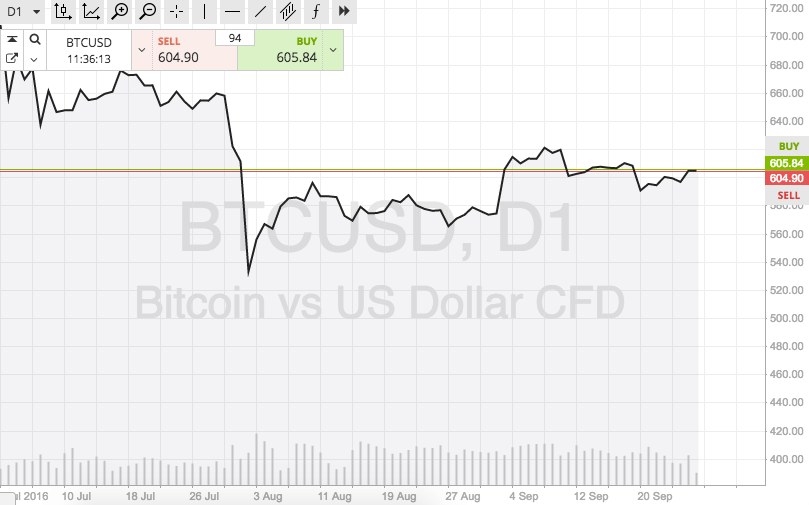

So, let’s get to the detail. As ever, take a quick look at the chart below to get an idea of the levels in focus. It’s a five-minute candlestick chart showing twelve hours of overnight action in the bitcoin price.

As the chart shows, the levels in focus for this morning are in term support to the downside at 600 flat, and in term resistance to the upside at 611.

If we see price run up to the upside and break through resistance, we will look for a close above this level to validate an upside entry, and a target of 617.

Conversely, a close below support will signal an equal but opposite trade, with a short position placed towards 594. A stop loss just the other side of the entry in both cases works well to define risk.

Charts courtesy of SimpleFX