Key Points

- Bitcoin price declined this past week and moved below the $10,000 level against the US Dollar.

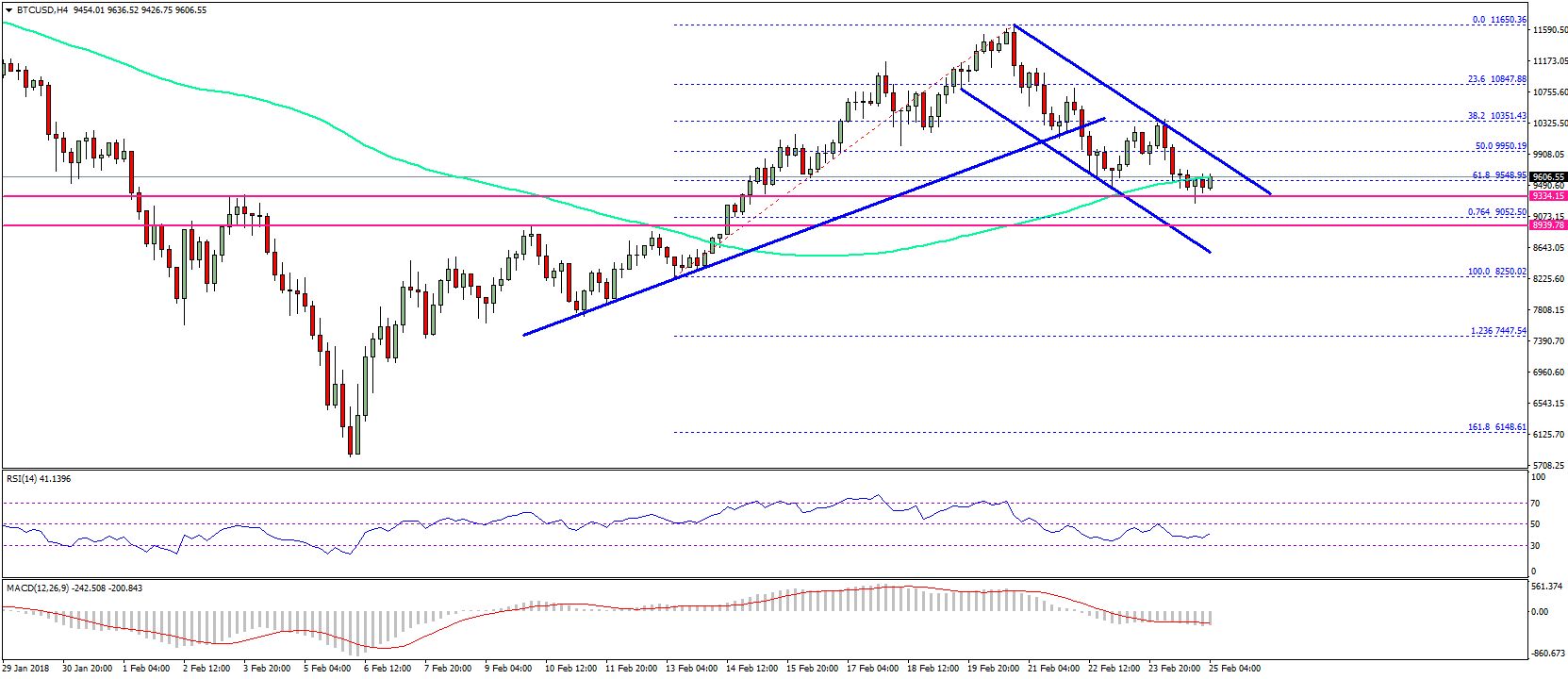

- There was a break below a major bullish trend line with support at $10,350 on the 4-hours chart of the BTC/USD pair (data feed from SimpleFX).

- The pair must stay above the $9,300 and $9,000 support levels to avoid further declines in the near term.

Bitcoin price is under pressure below the $10,000 level against the US Dollar. BTC/USD remains at a risk of more declines if the pair fails to hold the $9,000 support.

Bitcoin Price Resistance

This past week, there was an increase in bearish pressure on bitcoin price from the $10,800 swing high against the US Dollar. The price started a downside move and traded below the $10,500 support level. There was also a break below the 23.6% Fib retracement level of the last wave from the $8,250 low to $11,650 high. Moreover, there was a break below a major bullish trend line with support at $10,350 on the 4-hours chart of the BTC/USD pair.

The pair traded towards the $9,400 support and declined below the 100 simple moving average (4-hours). More importantly, there was a break below the 50% Fib retracement level of the last wave from the $8,250 low to $11,650 high. It has opened the doors for more losses below $10,000. On the downside, the $9,350 support is holding losses and is preventing declines. Should there be a break below $9,350, the price may even decline below the $9,000 level. An intermediate support is near the 76.4% Fib retracement level of the last wave from the $8,250 low to $11,650 high.

On the upside, a break above the $10,000 resistance is needed for the price to move back in the bullish zone.

Looking at the technical indicators:

4-hours MACD – The MACD for BTC/USD is currently in the bearish zone.

4-hours RSI (Relative Strength Index) – The RSI is currently well below the 50 level.

Major Support Level – $9,350

Major Resistance Level – $10,000

Charts courtesy – SimpleFX

SOS different day. Draw lines on a chart and prognosticate.