Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

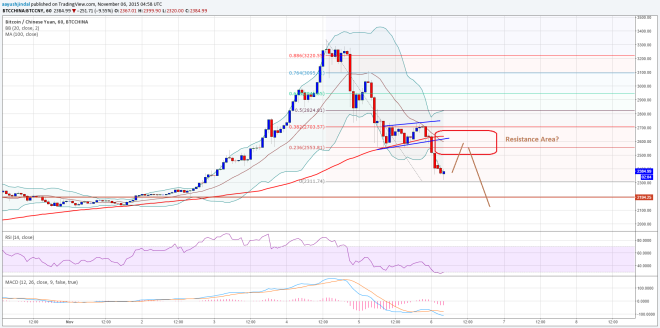

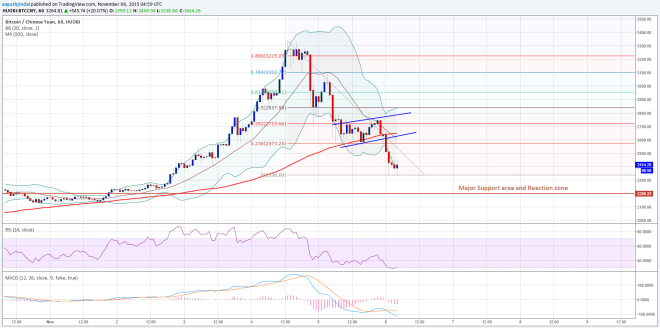

- The Bitcoin price after trading as high as ¥3340 against the Chinese Yuan found resistance and started correcting lower.

- BTCCNY has cleared a major support area and looks set for more declines if sellers remain in control.

- A test of a major support area at ¥2200 is possible where there is a chance of buyers taking a stand.

Bitcoin price enjoyed a solid bullish ride recently, but it looks like it has started a corrective phase that might continue moving ahead.

Sell Rallies?

The Bitcoin price after struggling to clear the ¥3400 level started to correct lower. However, it looks like the corrective rally has gone too far, as the price broke an important support area of ¥2500. The stated break might come as an encouragement for sellers to take the price further down. There was a flag pattern formed recently on the hourly chart, which was breached to clear the way for more losses.

The price is currently finding bids around ¥2340, which might ignite a small pullback in two waves. An initial resistance in this case may be around the 23.6% Fib retracement level of the last DROP from the ¥3340 high to ¥2336 low. The mentioned Fib level is also positioned around the broken flag support, suggesting ¥2570 may act as a hurdle for buyers.

Looking at the indicators:

MA – The 100 hourly simple moving average (SMA) is perfectly aligned with the highlighted resistance area of ¥2570, pointing it as a sell zone.

RSI (Relative Strength Index) – The hourly RSI is around the oversold readings, suggesting a minor pullback is possible moving ahead.

On the downside, a break below the recent low of ¥2336 may open the doors for a test of ¥2200.

Intraday Support Level – ¥2336

Intraday Resistance Level – ¥2570

Traders may keep an eye on the ¥2570 resistance area for a possible sell opportunity.

Charts from BTCCHINA and HUOBI; hosted by Trading View