Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

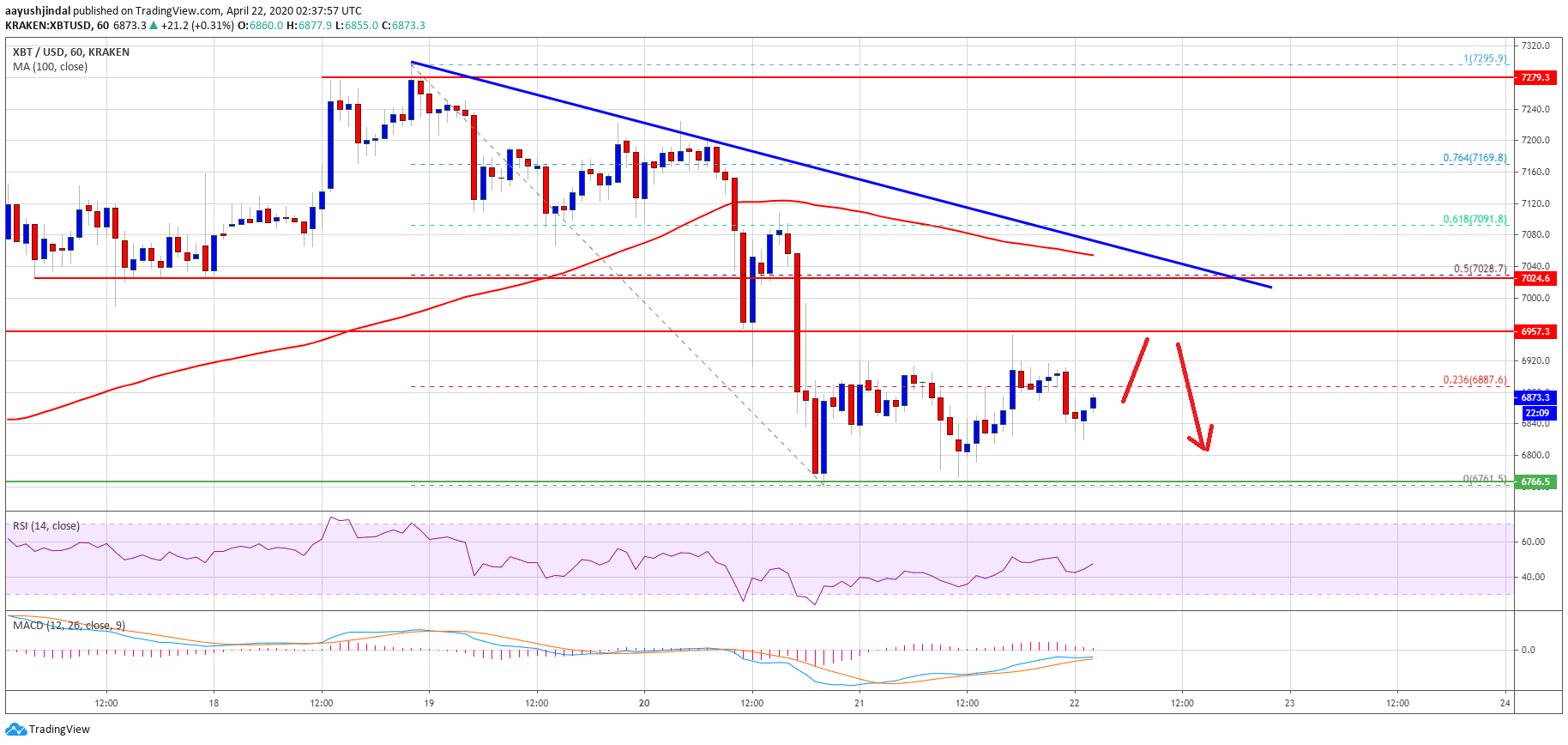

Bitcoin is currently consolidating above the $6,760 low against the US Dollar. BTC price could correct higher, but upsides are likely to face hurdles near $6,955 or $7,030.

- Bitcoin is showing signs of an upside correction from the $6,761 low against the US Dollar.

- A few key hurdles are forming on the upside near the $6,955 and $7,030 levels.

- There is a major bearish trend line forming with resistance near $7,030 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue lower towards the $6,550 support area, where the bulls are likely to emerge.

Bitcoin Facing Hurdles

Yesterday, we saw a 5% decline in bitcoin price below the $7,000 support area against the US Dollar. BTC even broke the $6,800 support level and the 100 hourly simple moving average.

It traded as low as $6,761 and it is currently consolidating losses. There was a break above the 23.6% Fib retracement level of the downward move from the $7,295 high to $6,761 low.

An initial resistance on the upside is seen near the $6,955 level (the recent breakdown zone). The first major resistance is near the $7,000 and $7,030 levels. There is also a major bearish trend line forming with resistance near $7,030 on the hourly chart of the BTC/USD pair.

The trend line coincides with the 100 hourly simple moving average at $7,035. Besides, the 50% Fib retracement level of the downward move from the $7,295 high to $6,761 low is near the $7,028 level.

If there is an upside correction, bitcoin bulls are likely to struggle near the $7,000 and $7,030 levels. A successful close above the trend line, the 100 hourly SMA and $7,050 could open the doors for a fresh increase. The next key hurdle above $7,050 is near the $7,200 level.

Main Uptrend Support

If bitcoin fails to continue higher, it remains at a risk of more downsides below $6,800 and the $6,761 low. The next major support is near the $6,555 level, where the bulls are likely to take a stand.

If the bulls struggle to keep the price above the main $6,555, there is a risk of a larger decline towards the $6,200 and $6,000 support levels in the near term.

Technical indicators:

Hourly MACD – The MACD is currently losing momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $6,750 followed by $6,555.

Major Resistance Levels – $6,960, $7,030 and $7,200.

Image from unsplash.