Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has mounted a strong recovery since the lows seen last week. The leading cryptocurrency traded as high as $9,750 on Saturday, over 13% higher than last weekend’s lows.

Even still, there remain textbook technical indicators suggesting there is a “high chance” BTC sees a correction in the coming weeks. According to the analyst that made this observation, this may be the largest correction Bitcoin has seen since March’s capitulation event.

Watch Out: Bitcoin Could Fall in the Next 2 Weeks

BTC may have bounced strongly since last week’s correction lows, but the asset’s weekly chart is printing four textbook signals indicative of an impending correction. A analyst recently shared these signals:

- The Tom Demark Sequential has printed a “9” candle. The time-based indicator prints “9” or “13” candle near or at inflection points in an asset’s trend. This latest “9” suggests an end to the Bitcoin rally that has transpired over the past few months.

- Hidden bearish divergences have formed between the Klinger indicator and the price.

- The Stochastic Relative Strength Index (RSI) has seen a bearish cross for the first time since February.

- Bitcoin formed a “Heikin-Ashi spinning top” pattern last week, which suggests a likely trend reversal.

Adding to the confluence, there remains sell-side resistance on Bitfinex’s BTC/USD order book.

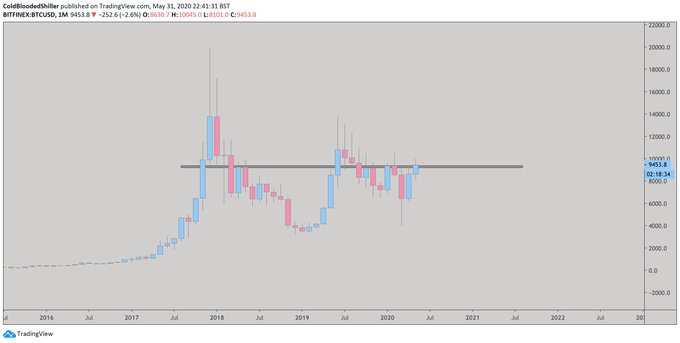

Below is a chart of recent BTC price action alongside the Order Book Dominance Bands indicator, which shows there is resistance from investors to let the asset pass the low-$10,000s.

The chart is significant because the order book data accurately predicted the tops of previous BTC rallies.

Related Reading: Ethereum DeFi Nears $1 Billion Milestone Again, and That’s Big for the ETH Bull Case

Long-Term Outlook Still Bullish

The case may be growing for Bitcoin to correct in the short term, but that’s not to say that the uptrend formed from the $3,700 lows is over. Far from, some analysts have said.

As reported by NewsBTC previously, BTC just closed the price candle for May above the crucial $9,360 level.

This is “incredibly significant for bulls” because the low-$9,000s acted as macro resistance for BTC on multiple occasions over the past year. As one analyst remarked in reference to the chart below:

“We’ve not had a Monthly close above 9360 in nearly 12 months. Rejections from this level have led to tests of $6k and eventually $3k.”

When Bitcoin failed to surmount this level in February, prices crashed to $3,700. Furthermore, when BTC rejected this level in 2018, there was a brutal bear market to $3,150 in the ten months that followed.

The fact that BTC has managed to clear this level suggests that the macro bear trend is over, leaving room for the cryptocurrency market to run higher.

Related Reading: Crypto Tidbits: Bitcoin Nears $10k, Goldman Sachs Talks Cryptocurrency, Chinese Yuan Slumps

Featured Image from Shutterstock