Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

I was having a chat with one of my friends, to whom I have introduced bitcoin lately, and he said

“Bitcoin has a limited number of coins, so it can’t grow to be one of the world’s top currencies”,

I answered him that Nakomoto designed bitcoin so that it has 100,000,000 units, which he named “satoshis”.

That’s when my friends was really amazed and started saying

“so, if one satoshi is equal to 1$, with more than 12 million bitcoins on the blockchain right now, the bitcoin economy would be worth more than 1200 trillion dollars and one bitcoin would be worth more than 100 million US Dollars, so it really has the potential to outgrow all other currencies”.

And I decided to write a piece about this theoretical question “Can Bitcoin ever grow so that one satoshi would be worth $1?”

Bitcoin’s Logarithmic Growth Curves:

I am one of those who believe that the price of bitcoin has followed the path of most assets that make it in free markets; as all begins with a slightly upward sloping trend, followed by a steep surge and then the bubble bursts and the price starts crashing. Yes, I believe that bitcoin price burst a few bubbles already; however, after each and every one of those bubbles; bitcoin price doubles the value it was before the bubble started to build up.

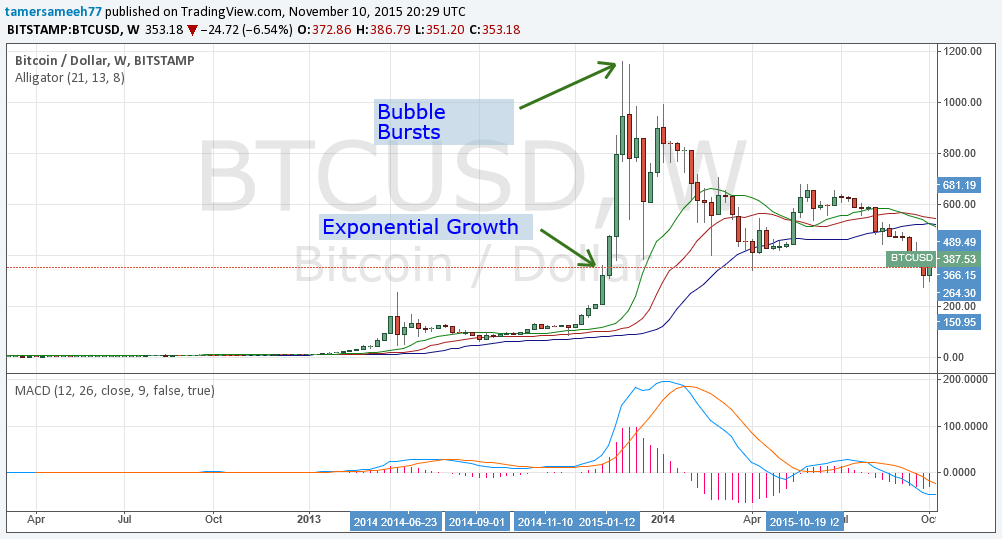

If we take a look at the weekly (BTC/USD) charts (take a look at the below chart), we can notice an exponential growth rate period, between September and November 2013, which was terminated by the a burst bubble after the price exceeded $1100.

Theoretically speaking, if this exponential growth rate would have continued throughout 2014, we would have seen bitcoin price now exceeding $20,000 now. However, I believe that the whole bitcoin economy is still suffering from the aftermaths of the “burst bubble” of 2013 and every price surge now is always feared to be followed by a steep drop leading to another burst bubble.

If by any means, Bitcoin can sustain a logarithmic growth curve for more than 20 years or so, we can see bitcoin’s price exceed 1 million USD, yet I don’t think this would ever happen!!

So are you thinking that Bitcoins will slowly fizzle out and die within 20 years?

Of course not, I am a true believer of bitcoin. I believe that Bitcoin can carry salvation to the world’s collapsing Fiat economy.

So those that think Bitcoin will be a useful alternative system rather than “salvation to the world’s collapsing Fiat economy” are not “true believers?” Is Bitcoin a religion or a software program?

No, never said that other bitcoiners aren’t true believers too, yet yes Bitcoin is like a religion to me, a way of life to decentralize everything and break the monopoly of big economies and legal militia on all aspects of life.

I think Bitcoin will be tool to help with those things but I think you will be disappointed with expectations like that.

Who knows? We will have to wait and see

Exponential growth does not continue indefinitely. I suggest you look into the “logistic function” otherwise known as an “S” curve. It describes things like population growth, or the growth of bacteria cultures, or the “network effect” that happens with things like the Internet or other new technologies. The two things you have to figure out are the exponent multiplier, and the maximum value (which I think is what you were really trying to explore in this article). Also, when showing exponential growth on a chart, it’s much more informative to make the vertical scale logarithmic (just a pet peeve of mine).

Yes, I agree and I also believe that a logarithmic scale would have been better.

at 210 million bitcoins final circulation, at $100,000,000 per bit coin = 21 Quadrillion – sound like a Zimbabwe style devaluation of the US dollar, but hey maybe Trump will catch on to this quantitative easing thing

def true that it would saturate the market and devalue if it ever got that high…but first, your number is wrong because that max coins allowed is 21 million, not 210.. and second.. that is still a hard cap. and the inability to “print more” will always assure its value. then its just a game of who holds the most.