Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

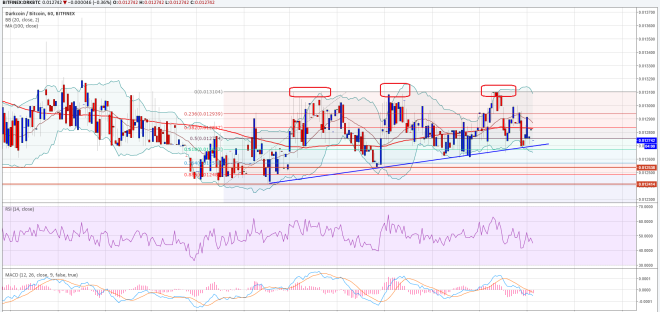

Dash Price Key Highlights

- As highlighted in the weekly analysis, the Dash price completed a sell pattern and moved lower.

- More losses are likely, as sellers remain in control and look to take the price lower.

- A bearish trend line is formed, which if broken might call for a change in the trend.

Dash price continued to weaken and might move further lower as long as sellers remain in control.

Trend Line Resistance

As anticipated earlier there was a major downside reaction in the Dash price, as it fell below a major support area of 0.0120BTC which ignited a sell rally. The price traded as low as 0.0111BTC where it found support and moved back higher. However, there is now a bearish trend line formed on the hourly chart, which is acting as a hurdle for more upsides. Moreover, the 50% Fib retracement level of the last drop from 0.0128BTC to 0.0111BTC also serving as a resistance for the price and helping sellers to remain in control.

There is also one important point to note as the price is well below the 100 hourly simple moving average, suggesting that buyers struggled a lot recently. As long as the price is below the trend line and 100 hourly SMA more losses cannot be discarded. The last low of 0.0111BTC can be seen as a support, and any further declines could take the price towards 0.0110BTC.

On the upside, a close above the 100 hourly SMA might encourage buyers in the short term. However, there is one more major hurdle on the upside, as the previous pivot of 0.0124BTC might now serve as a barrier for more gains.

Intraday Support Level – 0.0114BTC

Intraday Resistance Level – 0.0120BTC

The hourly RSI and MACD are heading lower, and pointing towards more losses in the near term.

Charts courtesy of Trading View