Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Digital asset manager Grayscale has launched a new DeFi fund with CoinDesk Indexes, according to a press release. The Grayscale Decentralized Finance (DeFi) Fund will offer its clients exposure to some of the major tokens in the sector.

The fund will track the CoinDesk DeFi Index, created on May 10, 2021, to “measure the investable DeFi market” with a basket of tokens. The Index follows a rules-based methodology and it’s maintained by TradeBlock, another CoinDesk subsidiary.

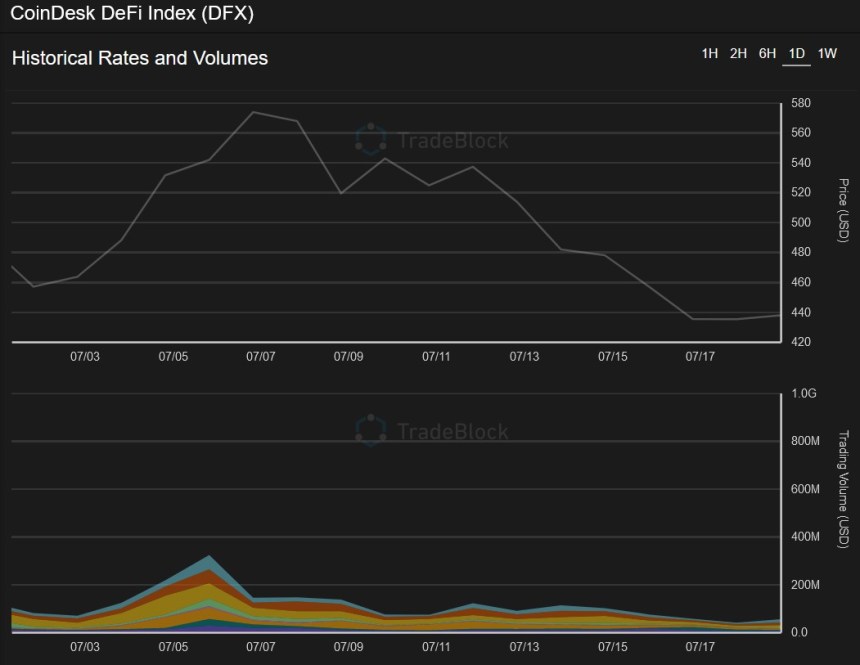

Since the beginning of July, the CoinDesk DeFi Index consist of the following assets: Uniswap (UNI) with 49.95%, Aave (AAVE) with 10.25%, Compound (COMP) with 8.38%, Curve (CRV) with 7.44%, MakerDAO (MKR) with 6.49%, SushiSwap (SUSHI) with 4.83%, and others.

At the time of writing, the index stands at $416 with a 6.94% loss in the 24-hour chart, as the crypto market continues to trend to the downside, as seen below.

Michael Sonnenshein, CEO of Grayscale Investments, claimed that the firm continues to offer its clients products to gain exposure to the most “exiting parts of the digital asset ecosystem”. Sonnenshein added:

The emergence of decentralized finance protocols provide clear examples of technologies that can redefine the future of the financial services industry. We’re proud to offer investors exposure to DeFi through Grayscale’s trusted, secure, and industry-leading investment product structures.

DeFi Amongst The Most Lucrative Sectors In The Crypto Market

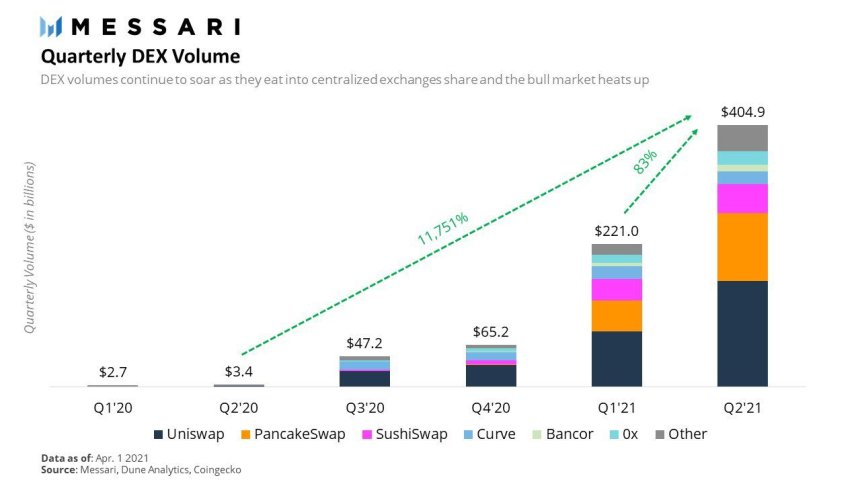

Data from Messari suggest the possible reason behind Grayscale new fund, DeFi, and its protocols have continued to grow in Q2 2021 despite the general sentiment in the market.

Researcher Roberto Talamas found that decentralized exchanges, such as Uniswap (UNI), reached $405 billion in terms of trading volume. This represents a 117x increase during 2021 and an 83% increase when compared with Q1.

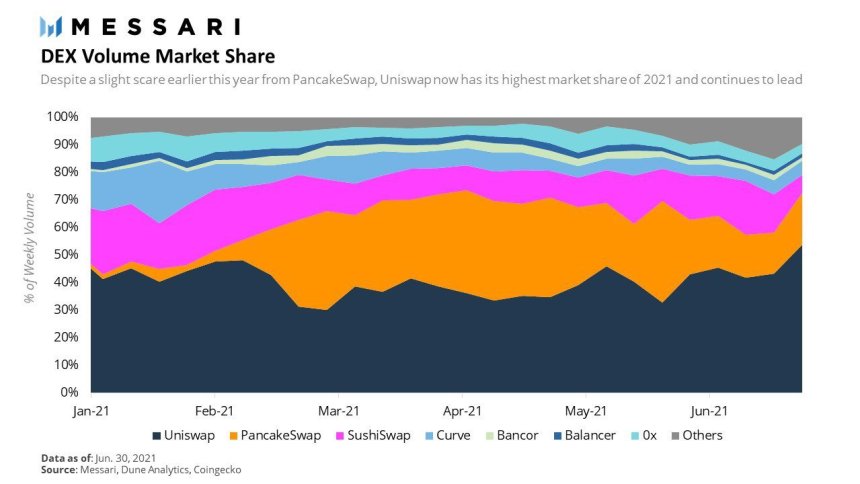

The third iteration of Uniswap has met users’ expectations. Thus, this DEX took a 54% market share followed by PancakeSwap, SushiSwap, and Curve. Therefore, seems logical that CoinDesk placed a high percentage of its index on this token.

Other use cases, such as stablecoins, lending and borrowing, derivatives, and yield aggregators also saw positive metrics with high participation from users. This suggests that DeFi is part of the most resilient sector in the crypto market.

The fund has been open for daily subscription, as the press release revealed. Managing Director of CoinDesk Indexes Jodie Gunzberg claims that this new partnership with Grayscale demonstrates their commitment to introduce institutional-grade products to the market. Gunzberg added:

With increasing attention on the innovations within decentralized finance, it’s critical for the investment community to have tools that deliver calculated exposure to this exciting area of innovation. This collaboration offers investors the data and tools they need to gain exposure to decentralized finance into their portfolios.

At the time of writing, UNI trades at $15.6 with moderate losses in the 24-hour chart.