DigitalNote Price Key Highlights

- DigitalNote price managed to correct a bit higher recently, but failed to gain momentum as sellers stepped in to prevent upsides.

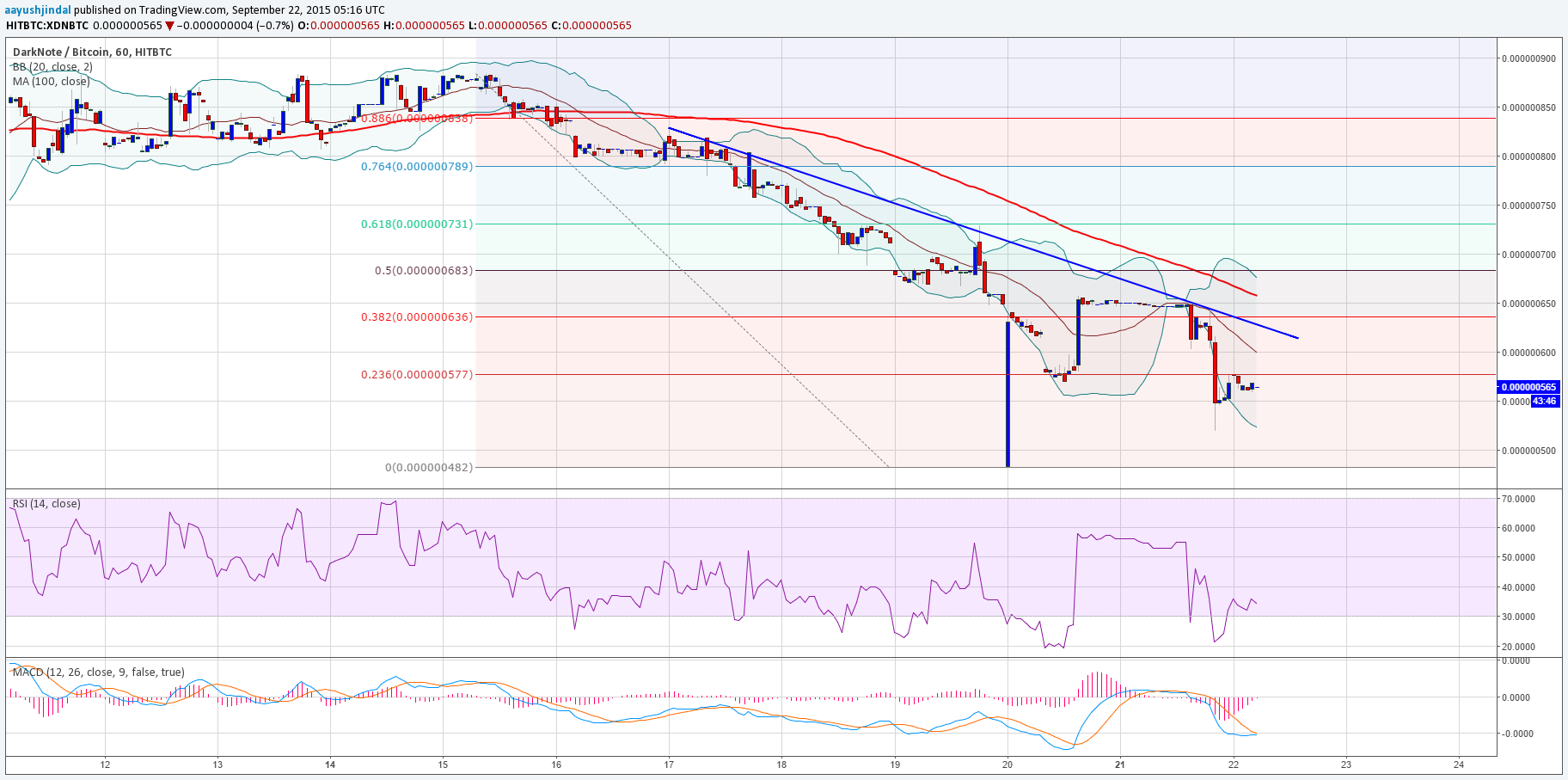

- As highlighted yesterday, a bearish trend line on the hourly chart prevented gains and stalled the upside.

- The last low of 0.000000482BTC is at risk and might be breached if buyers fails to protect the downside.

DigitalNote price remains at a major risk of one more push lower as sellers looks set to take control.

Perfect Rejection

The DigitalNote price attempted a short-term correction Intraday, but there was a complete failure noted around 0.00000065BTC. The price struggled to clear the stated level, and as a result, there was a downside move. There was a bearish trend line on the hourly chart (as highlighted in yesterday’s analysis), which acted as a barrier for buyers and prevented the upside. The price traded a touch above the 38.2% Fib retracement level of the last drop from the 0.00000088BTC to 0.000000482BTC. However, the trend line stalled gains.

As can be seen from the chart, the price is below the 100 hourly simple moving average, which is a concern for buyers in the near term. If there is another attempt to trade higher, then the trend line and resistance area might come into action. Only if there is a close above the 100 hourly SMA, there is a chance of a move towards the next area of interest around the 61.8% Fib level.

On the downside, the last swing low of 0.000000482BTC may act as a support. However, a break below it could be a bearish call and might take the price towards 0.00000045BTC in the short term.

Intraday Support Level – 0.00000055BTC

Intraday Resistance Level – 0.00000070BTC

The hourly RSI and MACD are in the negative territory, pointing more losses moving ahead.

Charts courtesy of Trading View