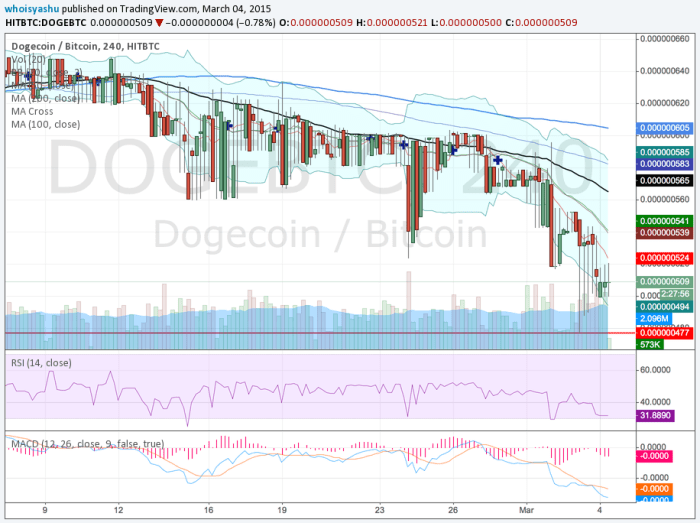

[Note: The price unit used in the following article is Satoshi.]

The Dogecoin price against Bitcoin seems to be having the roughest time of all top altcoins. The pair has been on an extended downtrend in the wake of recent sharp rallies in Bitcoin market. There is indeed a notable volume shift towards Bitcoin that has impacted the Dogecoin’s demand in the market; hence the fat depressions.

Speaking of the last 24 hours, the Dogecoin price continued to form lower lows; therefore validating its bearish moods. At one point of time, it dropped to as low as 47.7, invalidating the presumed support near 52. The Dogecoin price however made quick corrections after bring dropped in the alligator’s territory — the oversold area below the lower Bollinger Band curve — but continued to make lower lows without any hint of extensive bullish corrections.

By studying the 4H HITBTC chart above, we can see how Dogecoin price is indicating to stay in its gloomy bearish bias. Because:

- The Dogecoin Price is way too below its near and long term moving average curves.

- The RSI is suffocating inside a selling region (around 32 at press time).

- The MACD blue curve is digging the very ground it is standing on; way too below the normal line, and the saffron signal curve. It simply validates the overall bearish bias in the market.

Now lets have a look at the following 1H chart to understand the near-term support/resistance levels.

As you can notice the fibonacci retracement, plotted between the March 2nd’s higher high (near 59.6) and March 3rd’s lower low (near 47.7), the Dogecoin price is currently attempting to break above the psychological resistance near the average MA (52.5). If it succeeds, the upside risk will fall towards 50% retracement level 53.6. Though by looking at the Bitcoin’s current uptrend, we think Dogecoin price will bounce back from the black curve line in the chart above.

On the downside, the 50.1-support has been constantly retested in last few hours. In case it breaks down, the risk will fall towards the prevailing bottom at 47.7.

Conclusion

Setting your stop less near 50.1 will be a decent move, in case price tends to stretch its prevailing downtrend. Exiting the trade near 52.2 will ensure some profit.

I really hope Litecoin does not take Doge down in flames with it.

Also Doge block halving occured right around the time of the price drop (25th). May be related.