Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After earning the title of the worst investment of the year 2014, Bitcoin Trading may not need any further introduction when it comes to potential risks and losses. However at the same time, the market has been a haven for disciplined day traders that normally end up earning a greater returns within a shorter period of time.

One of the most attractive things about Bitcoin trading is the ability to use leverage. It gives traders an option to trade larger amounts even with small capital. In this context, the Bitcoin trading sector functions much like its experienced counterpart, the forex trading sector that also offers similar options to its traders.

For instance, a 50:1 forex leverage represents the ability of trader to place trades 50 times more than their actual capital. Similarly in, Bitcoin trading market, liquidity providers lets users open leveraged positions by providing their funds. These leverage ratios however are much lesser than those of forex, because of Bitcoin’s sustained high volatility. The maximum leverage we personally have came across is 50:1, provided by the Bitcoin exchange 796 and AvaTrade.

While it is true that high leverage yields high returns, the same is applicable in the case of losses as well. For instance, if you hold the capital worth $1 and borrow $50 leverage to trade on the Bitcoin market, with 1 pip being 1/100 of a penny, then a move towards favorable upside price direction, say for 100 pips, would yield the profit of $1, or 0.1 percent. So if you would trade, say a larger amount like $50,000 on your original capital $1,000, you would end up making a whopping $5,000 return.

But in case the price action ditches your predictability, the loss would be as much as the profit. So a leveraged trade worth $50,000, decreased by 100 pips, would cost you $5,000 plus interests, therefore putting your account balance in negative.

The same is applicable when you bet on downside price direction, by calling a short position. However in this case, what you borrow is Bitcoin rather than cash so as to sell them at a peak. Later you buy the same BTC from the downside position for cheap, and return lenders the Bitcoin your originally borrowed while taking away the profits. In case the prediction becomes invalid and the price starts to move north, you become obligatory to buy Bitcoins back at a high to pay your lender with interest.

Bitcoin Volatility Increase Risks on High Leverages

Day Traders are not serious investors, as they say. However, in terms of Bitcoin, investors are not serious day traders. We have seen how the cryptocurrency’s value has fallen from the overvalued $1,100 to an undervalued point within only a year — more or less. There will be no controversy in saying that many long term investors have got burned due to Bitcoin’s prolonged bearish phase, while many day traders meanwhile have made huge bucks by calling short positions.

At the same time, it is important to notice that only those professional traders managed to go home with profits who were limitedly dependent on leveraged trades. Indeed, they were focused more on managing near-term risks rather then fantasying massive returns. To cut a long story short, they understood how Bitcoin volatility could put a dent on their leverage if their prediction goes invalid; and therefore they borrowed less and played only for small gains by setting proper price limits.

We will be using a case study to demonstrate the impact of Bitcoin’s high volatility on leveraged trades.

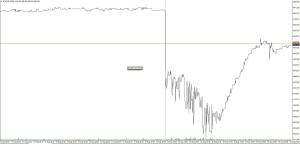

Last year, between 14th August to 18th August 2014, the Bitcoin price fell nearly $100 on all the major exchanges — an event that was famously referred as flash crash. Many experts interpreted the crash to have been caused by margin trading — a kind of leverage system that requires traders to deposit collateral to cover credit risk.

Margin Trading critic Raffael Danielli blamed a certain exchange for causing such a drastic drop, saying that:

“The fall below 400 was mainly due to a lack of bids in the order book and not because the market believed that the true value was below 400, as the rebound back to over 440 only minutes later basically proved.”

This is one of the most accurate cases for explaining a stiff situation for high-leverage trades that could be taking place in a highly manipulative and volatile environment.

There were still some who actually managed to avoid losses during such unannounced price movements. As the price crashed down to 400 from 500, many seasonal traders found this opportunity to call long positions on small leverage towards the upside risk 420. They eventually covered up their losses as the price literally bounced back above 420 to test the primary upside risk near 440.

Moral of the Story

Increasing your leverages could simply introduce amplified volatility to your Bitcoin positions. Thereby, it is ideal to place minimally leveraged trades, like most of the professional traders do. Many Bitcoin exchanges themselves have reduced their leverage-equity ratios after facing Bitcoin’s extended downtrends last year. Deposit more money, make less trades.

Chart Credits: BrCapoeira

Better idea! Don’t invest in the Crypto/alt farce period!

Bet you wish you held your Bitcoin idiot

So, how do you feel about that sentiment now?

ATTENTION! Investors in crypto and digital currencies are getting rich

daily, I personally have invested in bitcoin and ethereum. Do you wish

to trade crytocurrency? If you are keen and interested in investing in

cryptocurrencies or you’re already an investor in it but can’t see

yourself gaining due to poor account management or strategy. Contact me

without any hesitation via [kramerp04 @gmail .com] for private

tutorials, coin managements etc, and I will fully guide and assist you

with any information you may need to invest in these new and unpopular

crypto and digital currencies that are making waves at the moment.

Selling or buying bitcoins at furcoins. com is quick and easy, trust me, I use them regularly!