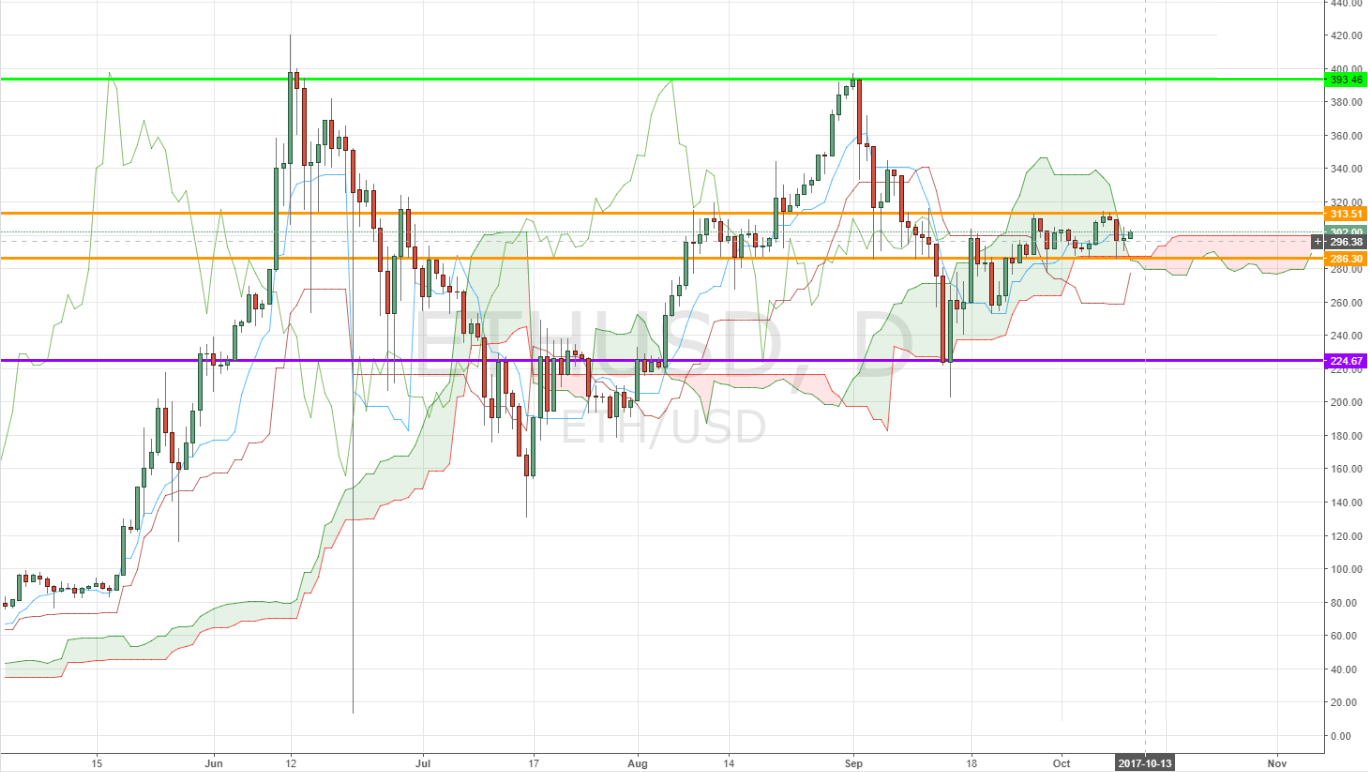

Ethereum ETHUSD: Ethereum has once again peaked above the daily Ichimoku cloud while the medium term market sentiment appears to be more of a consolidation. Bitcoin, on the other hand, has been making its moves back up towards the all-time high levels, which could ultimately lead to making new highs towards the end of the year.

A New Swap Code Between Bitcoin & Ethereum Now Available

As both Bitcoin and Ethereum remain the largest cryptocurrencies by market value, there is a new swap code between the two available on the blockchain technology. A team of cryptocurrency startup developers is open-sourcing technology that enables trustless trading between the bitcoin and Ethereum blockchains. As a result of the release, a now larger community of developers can play around with and build on top of the code. However, it is still important to note the technology is in its early stages.

A team of cryptocurrency startup developers is open-sourcing technology that enables trustless trading between the Bitcoin and Ethereum blockchains. As a result of the release, a now larger community of developers can play around with and build on top of the code. However, it is still important to note the technology is in its early stages.

Ethereum-Based Investment Product Now Listed On Nasdaq Stockholm

In other news, a new investment product focused on Ethereum is now open to investors on the Nasdaq Stockholm exchange. As of Wednesday morning, investors can now gain exposure to the price movement of ether via the trading of two new exchange-traded notes, or “ETNs,” on Nasdaq Stockholm.

While Bitcoin ETNs have existed for more than two years on Nasdaq Stockholm, This new addition makes the exchange the only European place to offer access to more than one cryptocurrency. Both Bitcoin and Ethereum ETNs were launched by the same group.

Technical Points: Ethereum ETH/USD

Looking at Ethereum’s daily chart as traded versus the US dollar, the ETH/USD pair finally confirmed above the daily Ichimoku cloud on Wednesday. However, the future cloud remains flat, and slightly on the bearish side. The candlesticks themselves appear to be in a consolidation mode, moving between a narrow range of 313 and 286.

A break above the pivot level of 313 could be our second bullish confirmation which could open doors for Ethereum prices to move higher once again, towards the all-time-high resistance level of 393.

Medium-term support is set at 224, the level Ethereum tested back in September. The level has previously acted as a resistance, which makes it stronger of a support.