Key Highlights

- ETH price continue to struggle against the US Dollar even after a successful Ethereum network 4th Hard Fork.

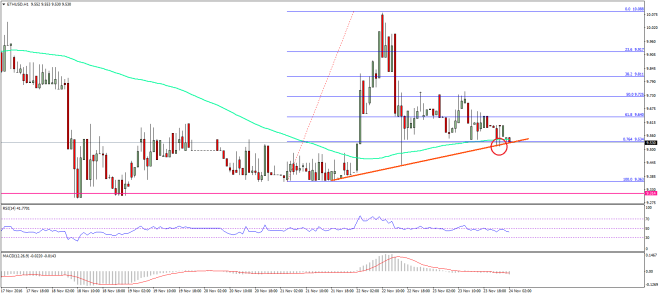

- There is a bullish trend line formed on the hourly chart (data feed via SimpleFX) of ETH/USD, which is currently holding the downside.

- A break below the trend line support area may open the doors for more losses.

Ethereum price is under a bearish pressure once again versus the US Dollar, and it looks like the ETH/USD pair may break the $9.50 support.

Ethereum Price Support

We all know that the Ethereum network 4th Hard Fork was successful. However, it did not help ETH price much, as there was no major upside move against the US Dollar and Bitcoin. In fact, the price moved down after the hard fork was completed. The price is currently under a bearish pressure, and trading near a major support area at $9.50, which holds the key in the short term.

The stated level is important because a bullish trend line formed on the hourly chart (data feed via SimpleFX) of ETH/USD is positioned near it. Also, the 100 hourly simple moving average is around the same trend line support. Lastly, the 76.4% Fib retracement level of the wave from the $9.36 low to $10.08 low is also around the same zone. So, we can say that the $9.50 support is a crucial juncture for the ETH/USD pair.

It won’t be easy for the pair to break it. However, if there is a break below it, then it may open the doors for more losses in the short term. So, if you are a seller, watch out for the highlighted trend line and support area.

Hourly MACD – The MACD is now back in the bearish slope, but with less momentum.

Hourly RSI – The RSI has moved below the 50 level, which is not a good sign.

Major Support Level – $9.50

Major Resistance Level – $9.80

Charts courtesy – SimpleFX