Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

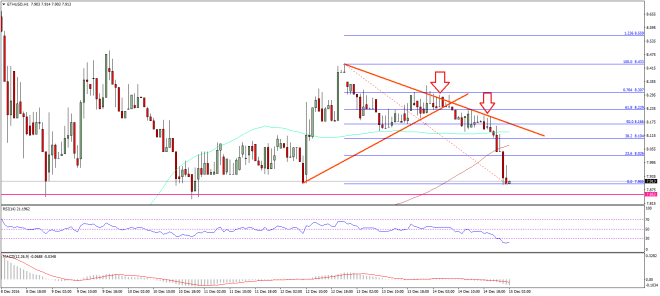

- ETH price failed to gain traction against the US Dollar, and broke a short-term bullish trend.

- Yesterday’s highlighted connecting bullish trend line on the hourly chart (data feed via SimpleFX) of ETH/USD failed to hold the downside.

- The pair is approaching a major support area at $7.85 where buyers may appear.

Ethereum price failed to gain momentum against the US Dollar and Bitcoin. It looks like the ETH/USD is positioned for a test of $7.85.

Ethereum Price Downside Break

Yesterday, I was hoping for a minor bounce in ETH price versus the US Dollar. However, there was no major increase in the bullish momentum and buyers failed to hold the gains. As a result, there was a downside move, taking the price below the $8.10 support area. The most important point was the fact that yesterday’s highlighted connecting bullish trend line on the hourly chart (data feed via SimpleFX) of ETH/USD failed to hold the downside.

Moreover, the pair also broke the 61.8% Fib retracement level of the last wave from the $7.95 low to $8.43 high to clear the way for more downsides. The pair also broke the $8.10 support to trade as low as $7.90. The price is currently attempting a recovery, but may face sellers near a bearish trend line formed on the same chart. Moreover, the 23.6% Fib retracement level of the last decline from the $8.43 high to $7.90 low may also act as a resistance.

So, if the ETH/USD attempts to correct higher, then it may face sellers near $8.02 and $8.10. The trend line resistance is the most important hurdle for a change in the trend. On the downside, the $7.85 is a monster support area.

Hourly MACD – The MACD has changed the slope from bullish to bearish.

Hourly RSI – The RSI is currently around the oversold readings, so there can be a minor correction.

Major Support Level – $7.85

Major Resistance Level – $8.10

Charts courtesy – SimpleFX