Key Highlights

- ETH price after moving as high as $317 against the US Dollar found resistance and started a correction.

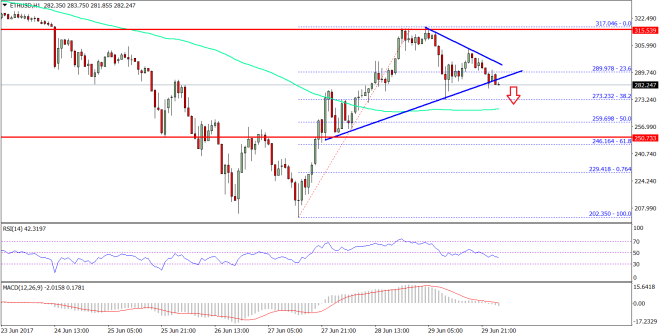

- The ETH/USD pair is currently attempting a break below a bullish trend line with support at $284 on the hourly chart (data feed via SimpleFX).

- There is a chance that the price may move down and test the $266 support zone.

Ethereum price has started a correction against the US Dollar and Bitcoin, and now ETH/USD may move down and test the 100 SMA or $266.

Ethereum Price Support

Recently, we saw a rise in ETH price above $300 against the US Dollar. A new weekly high was formed near $317 where sellers emerged and pushed the price lower. It looks like a correction wave is initialized and the price may decline towards $270-260. It is currently below the 23.6% Fib retracement level of the last wave from the $202 low to $317 high.

At the moment, the ETH/USD pair is currently attempting a break below a bullish trend line with support at $284 on the hourly chart. It the pair succeeds in a close below the trend line support at $284, there are chances of more declines in the near term. The next support is around the 38.2% Fib retracement level of the last wave from the $202 low to $317 high at $273. However, the most important support is near the 100 hourly simple moving average at $266.

Any further declines or corrections should be limited by the 50% Fib retracement level of the last wave from the $202 low to $317 high. On the upside, the there is a minor connecting bearish trend line at $292. It may act as a short-term hurdle for gains above $300.

Hourly MACD – The MACD is slowly moving into the bearish zone.

Hourly RSI – The RSI is now below the 50 level and heading lower.

Major Support Level – $266

Major Resistance Level – $292

Charts courtesy – SimpleFX