Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

- ETH price failed once again to clear a major resistance area against the US Dollar, and was seen trading in a range.

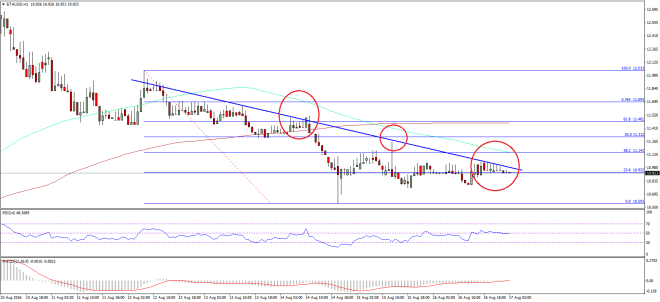

- I highlighted a bearish trend line on the hourly chart (data feed via SimpleFX) of ETH/USD this week, which is still acting as a monstrous resistance for ETH.

- The price attempted at least 10 times to break it, but failed to gain traction.

Ethereum price ETH struggle to clear a monster resistance trend line continues. The buyers have to clear it in order to take the price higher.

Ethereum Price Range

Ethereum price ETH attempted to clear a bearish trend line on the hourly chart (data feed via SimpleFX) of ETH/USD yesterday, but failed. I have been tracking the highlighted trend line for a few days, and stated yesterday that it holds the key in the short term. The price continued its struggle to break it and trade above it, which is not a good sign for the bulls.

During the past 10 hours, there were at least 6 attempts to break the highlighted bearish trend line. It clearly shows the price is lagging momentum to move higher, which may result in a downside move. The price is currently ranging around the 23.6% Fib retracement level of the last drop from the $12.03 high to $10.59 low with very low trading volume. So, there can be a flush in the short term before there can be an upside move.

The ETH/USD pair may trade higher only if there is a break above the highlighted bearish trend line. In my view, there can be a move below $10.80-50 level before the ETH bulls step in.

Hourly MACD – The MACD is almost flat, but showing signs of changing bias in the short term.

Hourly RSI – The RSI just curved away from the 50 level, and failed to break the stated level.

Major Support Level – $10.80

Major Resistance Level – $11.00

Charts courtesy – SimpleFX