Key Highlights

- Ethereum price managed to start a recovery after trading as low as $5.68 against the US Dollar.

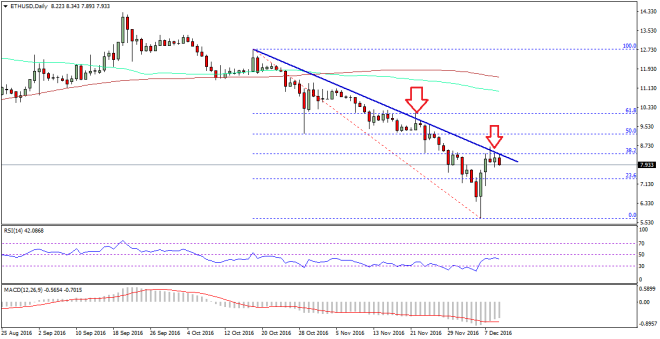

- The current recovery is facing resistance near a major bearish trend line formed on the daily chart of ETH/USD (data feed via SimpleFX).

- A break above the highlighted trend line resistance may ignite an upside move.

Ethereum price is recovering well at the moment against the US dollar and Bitcoin, but also reaching a major pivot area.

Ethereum Price Hurdle

There was a major decline in Ethereum price against the US Dollar and BTC before starting a recovery. ETH/USD traded as low as $5.68 where the buyers appeared and started a recovery. There was a move above the 23.6% Fib retracement level of the last decline from the $12.68 high to $5.68 low. It means there is a chance of further gains in the near term if the buyers remain in control.

There is a major bearish trend line formed on the daily chart of ETH/USD (data feed via SimpleFX). It is currently acting as a resistance and preventing an upside move. Moreover, the 38.2% Fib retracement level of the last decline from the $12.68 high to $5.68 low is also acting as a resistance. It looks like the price is finding it very hard to break the trend line resistance.

If there is a break above the trend line, then there are chances of further gains in the short term. The next stop for the buyers could be around the $9.20 level. On the downside, the $7.50 level is a key support, and may act as a barrier for a break down.

Daily MACD – The MACD is still in the bearish zone, which is a concern for the ETH buyers.

Daily RSI – The RSI has recovered well from the negative zone, but still below the 50 level.

Major Support Level – $7.50

Major Resistance Level – $8.50

Charts courtesy – SimpleFX