Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In this episode of NewsBTC’s daily technical analysis videos, we are going to look at Ethereum using ETHUSD and ETHBTC ahead of the Merge.

Take a look at the video below:

VIDEO: Ethereum Price Analysis (ETHUSD & ETHBTC): September 6, 2022

Not much has changed in Bitcoin and other cryptocurrencies since last week. However, Ethereum continues to gear up for the upcoming Merge and posted some decent gains over the weekend. Here is a closer look at Ethereum performance ahead of the Merge.

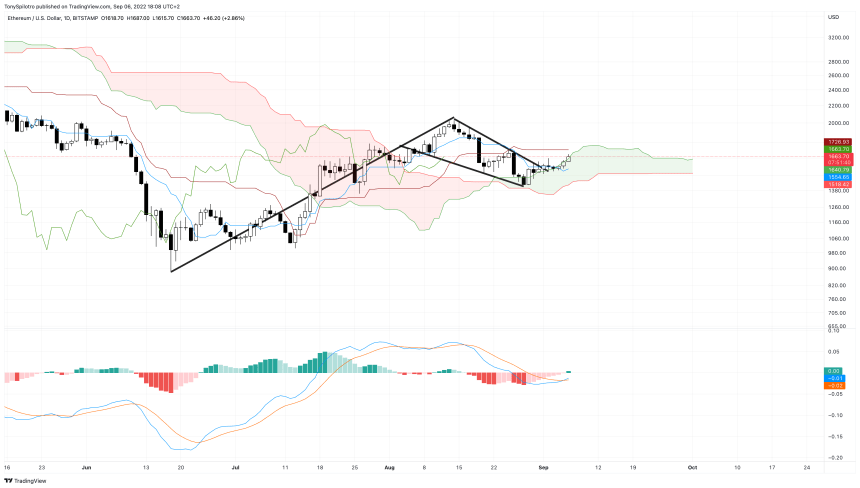

On daily timeframes, ETHUSD closed above the middle-Bollinger Band and should make another run at local highs. A potential bull flag breakout could hint at a larger rally. A bullish crossover of the LMACD also supports momentum carrying Ether prices higher.

Further adding credence to an up-move, ETHUSD is above the Tenkan-sen and is attempting to close above Kumo cloud resistance. Notably, Ether was rejected from the bottom of the cloud before losing support at around $2,500.

Will a bull flag lead Ethereum higher? | Source: ETHUSD on TradingView.com

The Signal From Ether’s Most Powerful Rallies

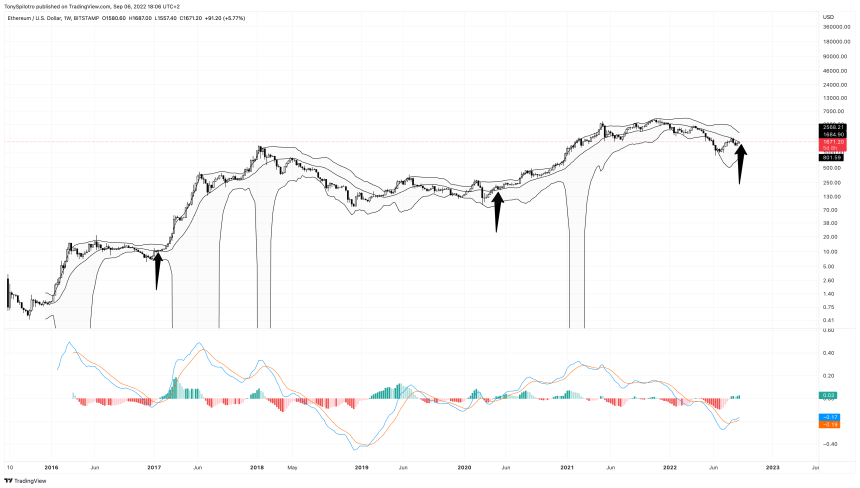

Ethereum is right up against the middle-Bollinger Band on weekly timeframes. Closing above the middle line, which is a simple moving average set at 20-periods, has led to some of the cryptocurrency’s strongest rallies. For example, in 2017, closing above it led to a 13,000% increase before a bear market started. The idea of a rally is possibly supported by a bullish crossover of the LMACD.

To truly become bullish, Ethereum must reclaim the Ichimoku cloud. However, price has already closed above the Tenkan-sen on the weekly which is a start. Interestingly, Bitcoin is still stuck below this line by comparison, while Ether is well above it.

Making it above the mid-BB could be significant | Source: ETHUSD on TradingView.com

Related Reading: WATCH: Bitcoin September To Remember: The Good, The Bad, & The Ugly | BTCUSD September 1, 2022

ETHUSD Future Forecast: A Storm Is Coming

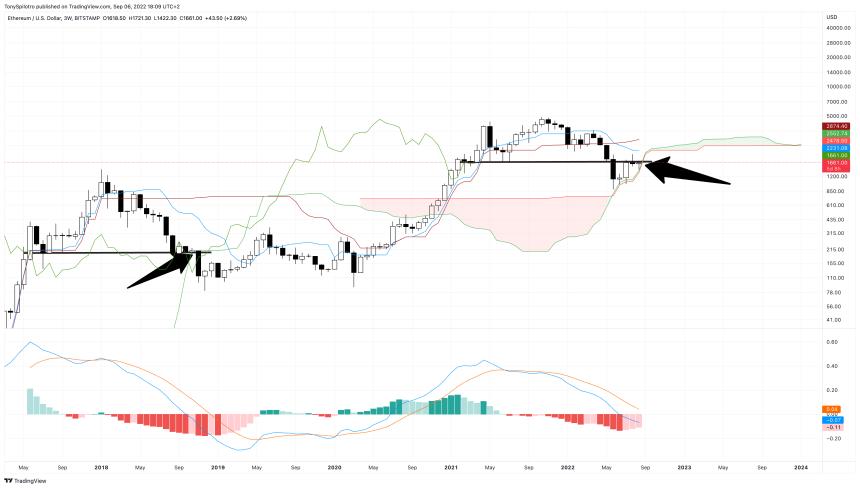

Before we move into a more direct comparison of Bitcoin and Ethereum, the rarely used 3-week timeframe could be very telling. There are only five days left in the candle and ETHUSD has to move up from the current level or else it will close through the Ichimoku cloud.

In the past, closing through the cloud led to a large down-move and the final bottom. It is worth noting that closing through the cloud swept support during the last bear market. This time around, support was already swept. Bearish momentum is also weakening on the timeframe according to the LMACD, so a reversal is possible.

The 3-week timeframe warns of danger or reversal | Source: ETHUSD on TradingView.com

The Merge To Lead Strong Outperformance Against Bitcoin

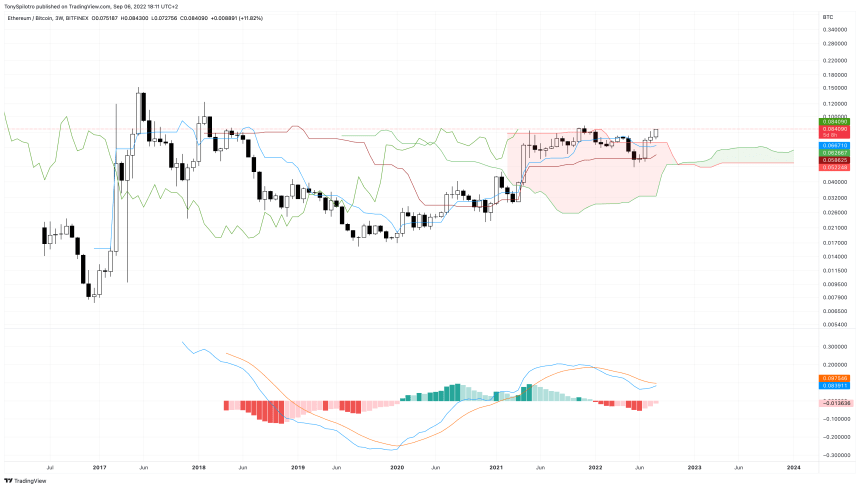

ETHBTC is above the mid-BB which in the past has led to some of the largest rallies, much like the USD trading pair example. Ethereum is also up against the upper Bollinger Band on weekly timeframes versus BTC so a similar push outside of the bands is possible.

Importantly, Ethereum retested the Ichimoku cloud on weekly timeframes and is pushing up against neckline resistance on a five-year long inverse head and shoulders bottom. From the head to the neckline was a 400% move, so the breakout from resistance could lead to enormous overperformance in Ethereum versus Bitcoin.

An inverse head and shoulders could send ETH higher | Source: ETHBTC on TradingView.com

Why A Massive Move Could Be Coming Against BTC

Finally, switching back to the 3-week timeframe used for the USD pair, Ethereum has taken out the cloud after retesting the Kijun-sen and confirming it as support. This also could hint at curved parabolic support forming. This is the first major consolidation after ETHBTC broke out from downtrend resistance, and the LMACD appears ready to cross upward and send Ethereum much higher versus Bitcoin.

Will the Merge be the catalyst crypto bulls are hoping for? Make sure to leave a comment in the video above. Remember to also subscribe to the NewsBTC YouTube channel and follow us on Twitter.

High timeframes suggest there are clear skies ahead for Ether | Source: ETHBTC on TradingView.com

Learn crypto technical analysis yourself with the NewsBTC Trading Course. Click here to access the free educational program.

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com