Volatility seems to have slowed down across the main cryptocurrencies after last week’s series of negative coverage. Ethereum price have lost momentum and is mostly losing ground against USD despite an overall positive fundamental market outlook.

Technical Points

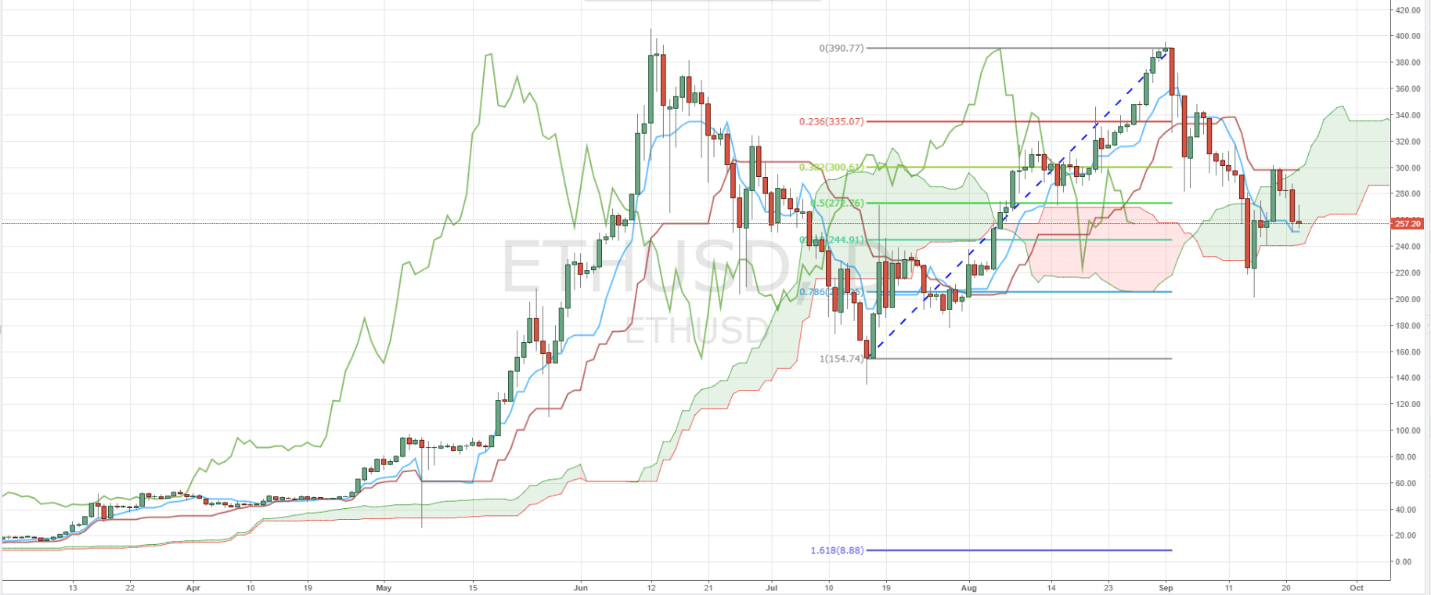

After testing briefly above the Ichimoku cloud the beginning of the week, the ETH/USD pair is now back inside the cloud under a bearish sentiment, with the Kijun line, Tenkan line and the Chiko line of the Ichimoku Kynko Hyo all heading down. The pair is currently testing aiming to test the 61% Fibonacci level of 244. From a long-term point of view, the pair could be in the process of forming a Double Top chart pattern, with the tops at resistance level of 390, and the neckline at 154.

If the fundamentals are not able to reverse the pair next week, we could see further drops towards the key support level 206.

Fundamental Points

Despite the recent bearish sentiment in the ETH/USD pair, we’ve had relatively positive news on Ethereum this week.

For one, French insurance giant AXA is using the public Ethereum blockchain to offer automatic compensation to air travelers in the event of a delayed flight.

With ‘Fizzy’, the new blockchain-powered insurance product, AXA is laying claim to be the ‘first major insurance group to offer insurance using blockchain technology.’ The ‘smart-contract’ insurance offering compensates passengers with a direct, automatic money reimbursement if the plane is delayed for over two hours.

On the other hand, the co-founder of Ethereum, Vitalik Buterin, said in an interview that Ethereum can replace things like credit card networks and even gaming servers in a couple of years. He believes a good blockchain application is something that needs decentralization and some kind of shared memory, and that is Ethereum. Right, now, however, the network is a bit too slow for most mainstream applications.

If Buterin is correct with his forecast, the Ethereum network could pose a real challenge to large financial institutions like Visa as soon as next year. Blockchain technologies like Ethereum are widely believed to be the next big disruptor for industries ranging from law to shipping.

Since the year began, there’s been no hotter investment than cryptocurrencies. Bitcoin and Ethereum, which are the one-two punch in terms of largest market cap among digital currencies, have returned about 300% and 3,200%, respectively, just since the year began. By comparison, it’s taken the S&P 500 decades to return what Ethereum has for its investors in just under nine months.