eToro is a leading social trading and investment platform with millions of users that has raised nearly $60 million since 2007, has recently introduced its has recently introduced its CopyFund trading strategy for cryptocurrencies to address the rapidly increasing demand from both individual and institutional investors towards bitcoin.

Investing in cryptocurrencies such as bitcoin, Ethereum, Ethereum Classic and Litecoin is fairly simple and transparent for long-time users but for beginner traders who only recently have exposed themselves to the relatively new asset class in bitcoin and cryptocurrencies, opening an account on traditional cryptocurrency exchanges, complying with strict Know Your Customer (KYC) and anti-money laundering (AML) policies can be difficult.

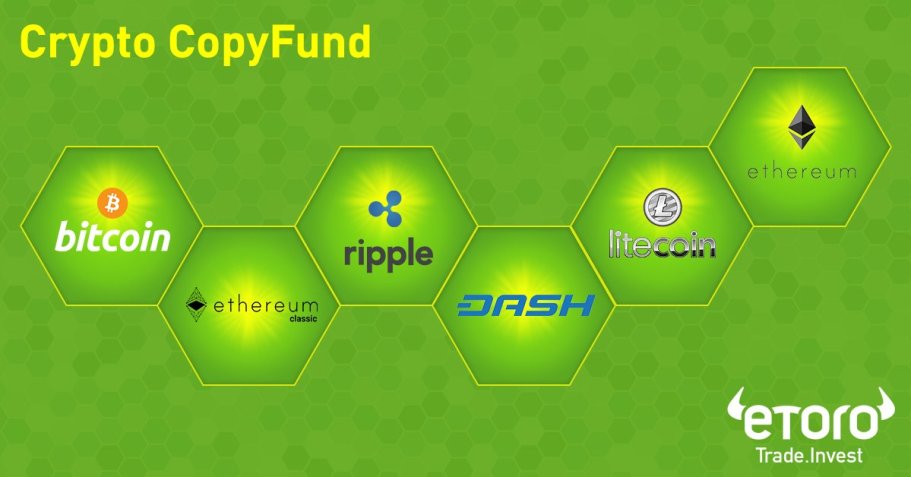

Crypto CopyFund enables investors that want to maintain a balanced and diverse portfolio of cryptocurrencies and assets to do so securely, efficiently and easily. According to the eToro team, the management team behind the Crypto CopyFund will only invest in cryptocurrencies with a market cap of at least $1 billion and an average trading volume of $20 million. Such investment methodology ensures that the cryptocurrency being invested by the Crypto CopyFund and its investors are highly liquid and legitimate.

In addition to the scheduled rebalancing of the portfolio in the beginning of each month, any cryptocurrency that falls below $1 billion in market cap will be excluded from the fund.

“The Crypto CopyFund will be rebalanced by eToro’s investment committee on the first trading day of each calendar month. Exclusion of a currency from the CopyFund will occur if that currency’s market cap drops below $1 billion, or if its average daily trading volume drops below $20 million,” said the eToro team.

There exists many investors within the cryptocurrency market that have invested in leading cryptocurrencies solely to learn about the market and expose themselves to the market class. Billionaire entrepreneur and investor Mark Cuban for instance revealed that he has invested in bitcoin and Ethereum to establish in-depth knowledge in the technical intricacies, philosophies, structures and financial aspects of both crypto assets.

With demand increasing at a rapid rate and mainstream adoption of cryptocurrencies such as bitcoin increasing in regions such as India, South Korea and Japan, the eToro development team came to a consensus that it is a viable time to introduce cryptocurrencies for investors in the market.

At the moment, the Crypto CopyFund contains bitcoin, Ethereum, Ethereum Classic, Dash, Litecoin and Ripple.

Most importantly, traders including Liam Davies, student at the University of Edinburgh, that know very little about financial markets and the cryptocurrency market, can spend less than an hour on a daily basis to manage the Crypto CopyFund and see high returns based on the performance of the cryptocurrency market.

“On average I spend an hour or two a day working on my portfolio. I try to design my trading strategy to fit around my other commitments. My studies are very important so I find it best to make longer term trades which I can check when it suits me. Trading has allowed me to pay for a lot of things. Normally, I would have needed a part-time job instead, so it actually frees up a lot of my time, allowing me to focus on my studies,” said Liam.

Emphasizing the exponential growth of bitcoin and the cryptocurrency market, eToro CEO Yoni Assia stated:

“2017 has been a defining year for cryptocurrencies. The global market has now topped $100 billion and the last few months alone have seen an influx of new cryptos entering the space. We believe that $100 billion is a milestone on the way to a Trillion USD market cap, and that a good strategy to capture this growth is by simply investing in the top billion dollar cryptocurrencies on a market cap weighted average.”

*All trading involves risk. Only risk capital you’re prepared to lose. Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Past performance does not guarantee future results.

Image Credit: Creative Commons, No Attribution Required