The US Securities and Exchange Commission (SEC) is right about their decision to reject bitcoin exchange-traded funds, believes Jake Chervinsky of San Francisco-based Compound Finance.

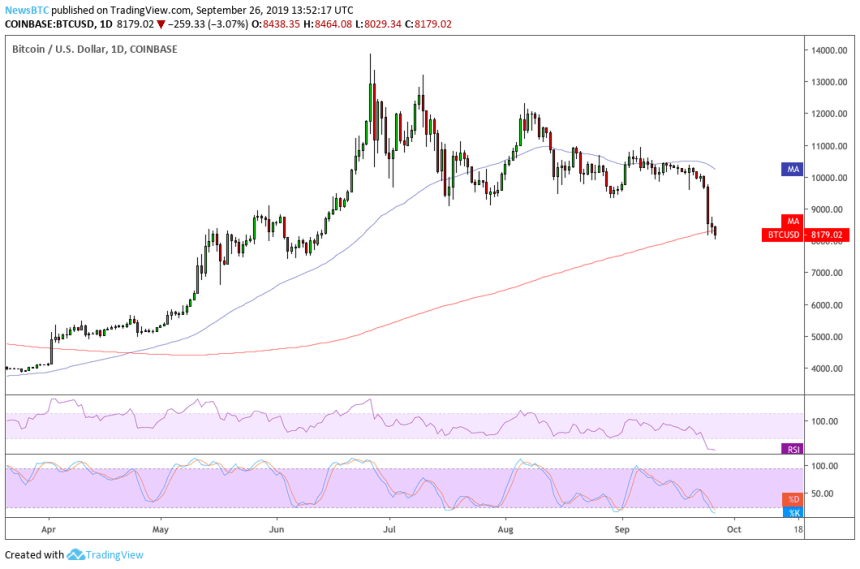

The general counsel on Thursday said the US securities regulator has valid concerns about bitcoin’s price volatility. He referred to the cryptocurrency’s latest price drop, wherein it plunged by as much as 20 percent in the matter of a few days. Chervinsky cited reports that showed how unregulated cryptocurrency exchanges operating outside the US played a crucial role in crashing bitcoin. It is the same concern that made the SEC hesitant to allow an ETF focused on a mostly unregulated Bitcoin market to make its way to the public.

“Bitcoin drops 20% over a few days; there’s no simple explanation for why; the drop made big money for offshore unregulated margin trading platforms; trading on those same platforms might’ve caused the drop in the first place; you’re still wondering why the SEC has concerns?” – noted Chervinsky.

Too Risky

ETFs are investment vehicles that track the performance of particular assets. It allows investors to diversify their investments without needing to own the asset. A Bitcoin ETF, therefore, will enable investors to speculate on the bitcoin price without needing to go through the complicated process of storing and managing the cryptocurrency physically.

To the crypto world, a Bitcoin ETF is good news since it adds a more accustomed, regulated layer atop the cryptocurrency market. That could bring more investors – both retail and institutional – to the bitcoin market, which could make them a crypto holder.

SEC, nevertheless, has rejected more than ten Bitcoin ETFs in the last two years. The regulator sees the cryptocurrency’s underlying market as a hub of price manipulation, money laundering, and risky volatility. While essential players in the bitcoin market are gradually catering to those concerns, a full-fledged ETF remains a far-fetched reality mainly when the cases of extreme manipulations are still occurring.

BitMEX

Chervinsky, in his comments, was referring to BitMEX, a Seychelles-based bitcoin derivatives exchange that offers traders with 100x leverage. Analysts believe that the controversial firm executed margin calls and liquidated contracts worth more than a billion dollars. The so-called Long Squeeze saw investors selling their Long positions in a falling bitcoin market. That led to a further crash, bringing bitcoin to as low as $8,100.

Many also believe that investors dumped bitcoin while taking cues from the launch of Bakkt. The Intercontinental Exchange-backed digital asset platform introduced two physically-settled bitcoin futures contracts on September 23. On the day, the trade volume was low, which, coupled with a 30 percent hashrate drop, could have influenced traders to exit their Long positions. Nevertheless, for Chervinsky, the sum of all analysis remains the same: the SEC won’t approve a Bitcoin ETF.

Sure, reasonable, but some other guy says it was "sell the news" on the Bakkt launch, & another guy says it was the hashrate drop, etc. Even if you're right & they're wrong, try telling the SEC, "don't worry, it's not manipulation, we can explain it all by technical analysis." 🤨

— Jake Chervinsky (@jchervinsky) September 26, 2019