Litecoin gave us another glimpse of its highly volatile nature in yesterday’s trading session. In my previous analysis titled Sky is the limit, I had reiterated my opinion that Litecoin is expensive and should be avoided at current levels. Bullish participants may have realized the same when the cryptocurrency had a knee-jerk reaction.

Litecoin is presently trading down 3.06% at $5.214.

Image: https://www.tradingview.com/x/Ai2BIXQM/

Image: https://www.tradingview.com/x/Ai2BIXQM/

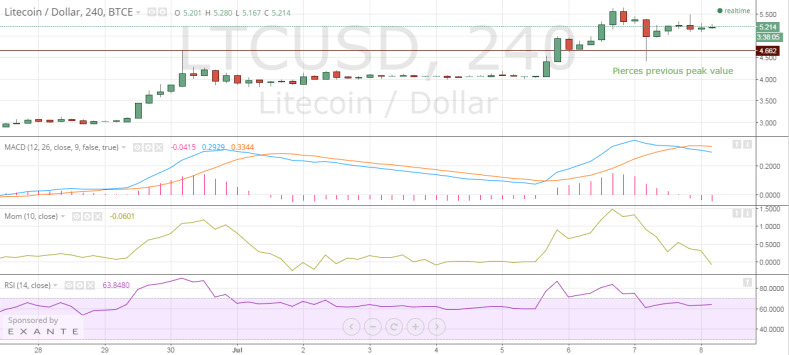

Looking at the 240-minute LTC-USD price chart, I can say that technical indicators are currently giving conflicting signals while the chart structure remains firm.

Litecoin Chart Structure – At one point of time, Litecoin was down 18% from our previous observation of $5.379 to $4.412 before it quickly trimmed the losses. As the buyers bought on the dip, the price was once again elevated to $5.495, at which it started witnessing profit booking once again.

It must also be noted that during the collapse, Litecoin pierced the previous peak of $4.670.

Moving Average Convergence Divergence – The negative crossover of MACD with Signal Line indicates bearish price action for the future sessions. The MACD now has a value of 0.2929 while the Signal Line has a value of 0.3344. This has pressed the Histogram into the sub-zero region with a value of -0.0415.

Momentum – The Momentum indicator reading has undergone a deep cut. From yesterday’s highly encouraging value of 1.2939, the value has declined to a disappointing -0.0601.

Relative Strength Index – Contrary to MACD and Momentum, Litecoin continues to display remarkable strength. It has been 9 straight sessions when the RSI value has stayed above the 60-mark. The latest 14-4h RSI value is 63.8480.

Conclusion

Litecoin is maintaining its expensive valuations comfortably, supported by strong underlying strength. Mixed technical signals do not help the traders. I would suggest that market participants adopt a cautious approach and trade lightly. Look to short on higher levels but do not buy.

Litecoins were over $20. Overall there will be 4 times as many litecoins- there value will end up settling around 1/4 the value of bitcoins. They should hit around $40 come October.

Nikhil, you’ve been advising to sell for the last week or so, but the price just keeps rising. At one point do you factor in a bubble into the equation? Regardless of it looking oversold or what the charts say, the herd mentality looks to be gathering pace. What’s your opinion on this? With Bitcoins recent issues, there could be a chance that Litecoin sees even greater short-term growth.

Hi Chris,

Thank you for taking the time out to comment.

I know that I have been suggesting a ‘sell’ on Litecoin for quite some time now, but the bullish speculation has proved me very wrong on several occasions. I definitely see a bubble in Litecoin. Why? Because I do not see any fundamentally positive change that has occurred in the cryptocurrency domain in the past few months. There are rumors that the Greece crisis is a boost for Bitcoin but how?? Just on the speculation that a Grexit is inevitable and Greeks will rush to convert their money into Bitcoin. And with the recent problems in Bitcoin, Litecoin is turning out to be the new favorite. But why? No Greek is converting his/her funds into Litecoin.

I think it’s all the ‘market noise’ that is inflating the prices, which can reach even higher levels – nobody can really tell when the bubble will burst. We have seen a similar thing in the China stock market in the past year, where prices to continued to defy normal logic but look at how it’s all coming to an end.

Therefore, in all my short calls, I am advising strict stop-losses.

You have to understand the fundamentals of digital currency. Litecoin is faithfully following each step of bitcoin. Litecoins will halve production around the next 45 days. This only happens every 4 years and indicates half the total number of litecoins is already distributed. Litecoins have greater stability and age than other competitor altcoins,but are less expensive than bitcoins. They had a high of $48. As global markets and currencies become more unstable the safe haven effect of digital currencies will continue to grow. As these currencies become widely adopted there numerous benefits over cash and credit cards will drive their dominance.

Digital currencies are the answer to the currency wars & banks lock on money supply. By the time the rest of the world figures that out all the early adopters will be retired. The digital currencies will do to stock markets and banks what amazon did to book stores & mp3s did to cds. This is like the internet boom *100.

Nikhil, you’re ignoring several fundamental weaknesses in the BTC market that are driving movement into LTC. First, the ongoing discussion/argument over block size and a possible hard fork are making some people squeamish about bitcoin’s future. Second, the recent soft fork to BIP66 authentication was poorly handled, causing large amounts of lost work for miners, reducing the inflow of newly minted coins. Third, there is an ongoing effort by person or persons unknown to “spam the blockchain”, injecting hundreds of thousands of microtransactions, which has pushed the backlog of transaction authentications to previously unheard of levels.

Litecoin has managed to avoid all of these issues. The blocksize is appropriate for now and the forseeable future, a hard fork to more robust authentication was accomplished yesterday with zero distruption to processing, mining or transactions, and while Litecoin is not spam-proof it is highly resistant to such.

For these reasons I believe we’re seeing Litecoin “catch up” to Bitcoin, heading for a valuation of 1:30, or approximately $8.66 USD (with frequent pauses for profit-taking along the way). Where it goes BEYOND that is for those wiser and more experienced than I, but it’s been obvious that LTC has been massively underpriced and is now heading for a more market-aware base valuation.