Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

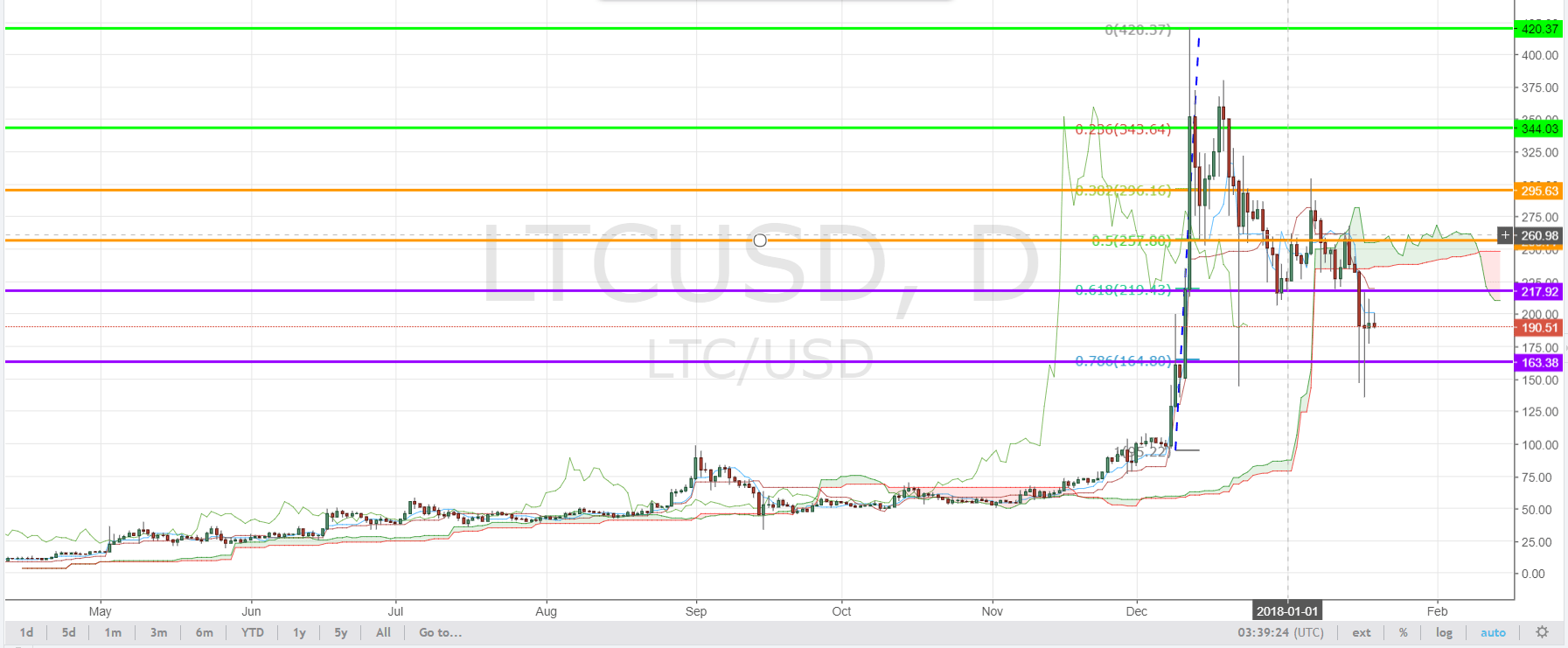

Litecoin was not immune from the cryptocurrency bloodbath this week. It dropped 50% from its all-time high and confirmed below the daily Ichimoku cloud. Here is a quick overview.

LTC/USD Price Action

After reaching the all-time high level of $420 in mid-December, LTC/USD started a brand new downtrend. It has been mainly supported by the 76% Fibonacci retracement level of $163, as it tested it once in December and twice in the past week.

It has also confirmed below the daily Ichimoku cloud, with the Tenkan line, Kijun line, and the future cloud in a bearish momentum. The Chiko span has yet to cross below the cloud though.

Unlike many of its major cryptocurrency counterparts, Litecoin has mainly been consolidating after the sharp plunge. It has formed a series of Doji candlestick patterns in the past few days, with no clear indication of its next direction.

How Are the Other Cryptos Doing?

Besides Ripple’s XRP which has shifted into a bullish momentum after the plunge, many other cryptocurrencies including Ethereum and Bitcoin are also in a consolidation mode.

Litecoin and Bitcoin are practically correlated because their use cases are very similar. If you consider Bitcoin as an asset like gold, Litecoin would be Silver.

Litecoin was created by former Coinbase engineer Charlie Lee in 2011 as a quicker alternative to Bitcoin.

What Was the Crash All About?

This week’s crash came after a global tide of regulation against the inchoate cryptocurrency industry. On one hand, these regulations may be scaring bitcoin investors into selling their coins now before the full impact of regulation makes itself felt. On the other, it may also be threatening suspect exchanges such as BitConnect, with its own token declining in value by 46 percent between December 17th and January 15th — the day before it announced its closure.

In the United States, regulation has reared its head in the form of the SEC.

But you can’t blame this all on the fundamentals. From a technical point of view, these drops were also noted as an inevitable flow of market sentiment. And the fact that the prices fell exactly to the key support levels, further strengthens our pullback theory.

Any Good News in the Cryptocurrency World?

Yes. First off, Japan’s biggest bank, Mitsubishi UFJ Financial Group Inc. is hopping on the cryptocurrency train. It is planning to release its own cryptocurrency coin by March 2018.

In the US, the housing industry is starting to dip its toes into the Bitcoin water. One Miami condo seller is only accepting Bitcoin offers, while online real estate brokers say several other listings are willing to accept bitcoin as a payment option.

These are certainly good news for cryptocurrency bulls. However, there is no doubt that the crypto market can still be very easily manipulated by bots and big players due to lack of regulation.